Tensions between Russia and Ukraine are at their highest in years. These geopolitical issues between Russia and Ukraine have kept investors on the edge in the past few days. Let us see how these issues are likely to impact the stock market.

To start with we need to know “What is the Russia-Ukraine Issue”?

- 1991 – Ukraine became independent as USSR broke up. It was a part of the Russian empire for centuries before becoming the Soviet Republic.

- 2014 – Ukrainian President rejected an association agreement with the European Union in favor of closer ties with Moscow. This led to mass protests and Russia responded by annexing Ukraine’s Crimean Peninsula and throwing its weight behind a separatist insurgency that broke out in Ukraine’s East.

- 2015 – A peace agreement brokered by France and Germany helped to end large-scale battles but failed to reach a political settlement.

- Current – Russia accused Ukraine of failing to honor the 2015 deal. Russia had troops deployed on the borders since 2021. The issue got escalated with Putin ordering troops into two pro-Russian, breakaway regions in Eastern Ukraine on the 21st of this month. In response, U.S. and allies announced sanctions on Russia. On Thursday Russia launched a military offensive against Ukraine. Ukrainian capital Kyiv and other cities were hit by airstrikes and Russian troops crossed the borders in several parts of the country.

How it may impact inflation?

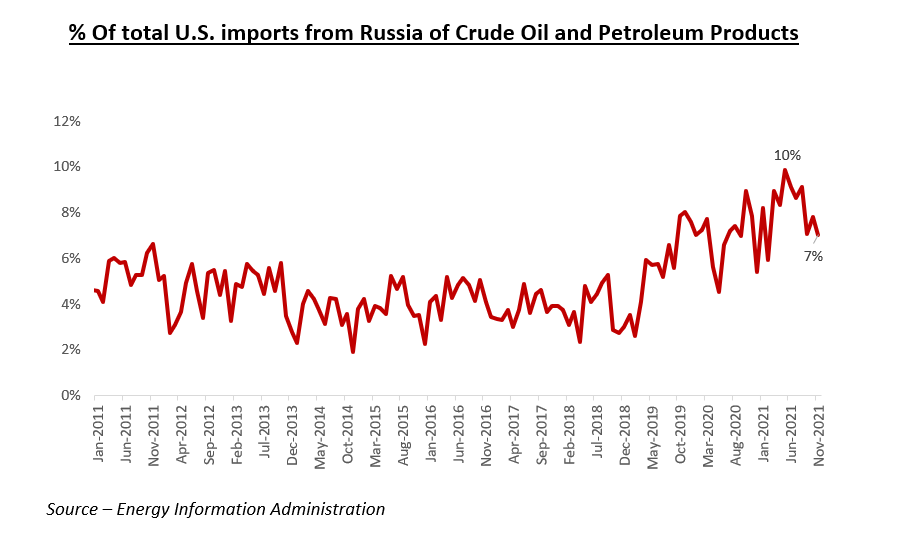

- Russia is a major exporter of crude oil, accounting for about 12% of the world’s supply. U.S. imports approximately 7% of its daily crude and other petroleum products from Russia.

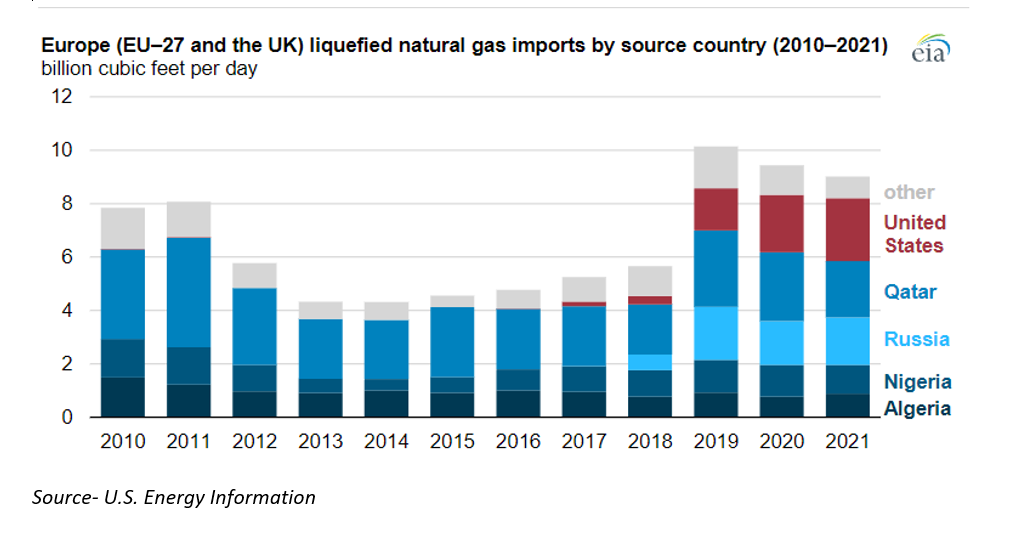

- On the other hand, Russia along with U.S. and Qatar form 70% of LPG received to Europe in 2021.

- In addition to energy, Russia is also the world’s top exporter of wheat, as well as a large producer of commodities, such as copper, nickel and platinum – all used in electric vehicles and electronics manufacturing.

Along with the supply chain issues which has already grappled the economy, a supply shock from the war will add fuel to the fire, meaning it will add to the already existing inflation in the U.S.

What will be the impact on markets?

Markets were already going through the uncertainty from the hawkish Fed since the start of the year on whether there will be 6 rate hikes or 7 rate hikes, in March will interest rise by 25 bps or 50 bps and when will the balance sheet unwinding begin are some of the questions markets were already trying to answer and absorb as evident from the fall we witnessed since January 2022.

The Russia-Ukraine issue is adding to the short-term uncertainty in the markets with oil prices reaching above $100 after 8 years. On whole. the rising energy prices and a supply shock with regard to other commodities will send the inflation even higher in the short term.

The only savior for red hot inflation will be the U.S. lifting sanctions on Iran’s oil exports. In case, the deal which is said to be in its final stage goes through, it will add to the supply of oil hence negating the impact on oil prices.

But meanwhile, Fed will have to decide if they are ready to be more hawkish than they already are which may potentially start impacting the economic growth as well.

We may further see the markets correcting in near future but the key is to pick stocks at attractive valuations as this macro cocktail gives investors an opportunity to invest in the markets – as Warren Buffet says “Be fearful when others are greedy and be greedy when other are fearful”