2022 is going to be different

2021 was a mixed bag with major indices touching their all-time highs while most of the stocks were near their 52-week lows towards the end of the year. No doubt that investors have made huge profits with markets rallying for the first 10 months.

High liquidity, growth in earnings, vaccination, and high economic growth – all these factors were responsible for the markets to go up.

But, 2022 is expected to be a different year meaning it may not be a broad-based index play it may be more about stock-specific investing and investors have to be more realistic in terms of return expectations for the next 12 months. Businesses that are fundamentally strong (whether growth or value), will continue to have growth in earnings, and where the valuations are in line with the expected earnings will do well. During the last 2 months of 2021, we have seen a lot of good stocks correcting – pricing in the rate hike expectations for 2022, slow economic growth, and less liquidity in markets which gives us a chance to invest in sound businesses at reasonable valuations.

Below are the headwinds for markets in 2022

-

High Inflation led by supply chain constraints

2021 witnessed the highest inflation to date which is expected to ease in 2022. But Omicron induced lockdowns may cause more supply chain disruptions leading to inflation going higher. Rising inflation will impact the earnings of the companies.

-

Interest rate hikes

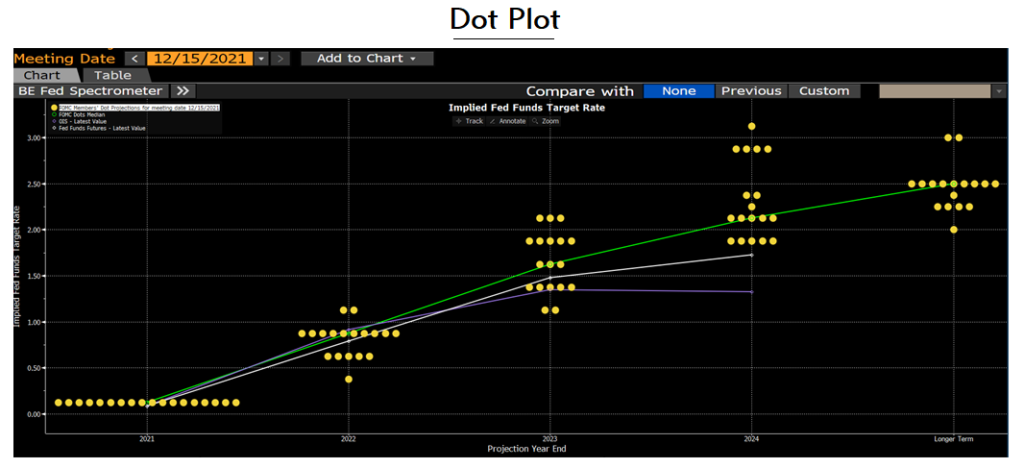

Central banks are looking to increase rates in 2022. Fed announced tapering of asset repurchase along with expectations of rate hikes which can be clearly seen from the dot plot below as on 14th Dec 2021. Also, the Bank of England raised interest rates for the first time in 3 years in December 2021.

In 2022, all eyes will be on rate hikes being actually announced given with every rate hike the cash flow of high growth stocks will be more vulnerable than that of defensive ones ultimately impacting the high valuations further.

Source – Bloomberg -

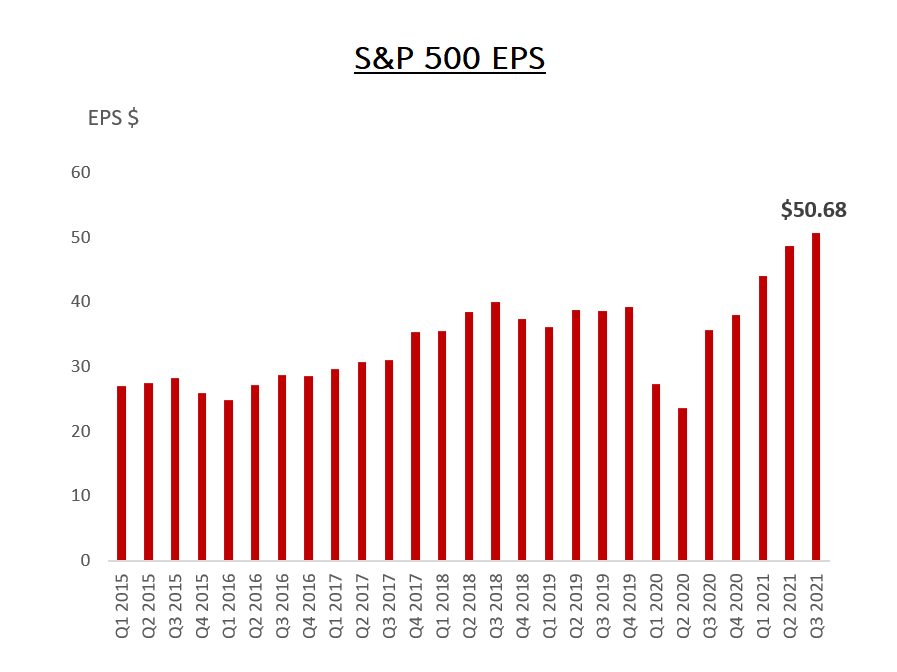

Lower growth in Earnings

Earnings for S&P have touched the highest number since 2015 due to pent-up demand, more money in hands of people. Normalized growth in earnings has already been priced in P/E which is higher than 10 yr historic average which means till companies do not report earnings that are already priced in the markets we may not see upside in the index due to stretched valuations.

Source – Bloomberg

-

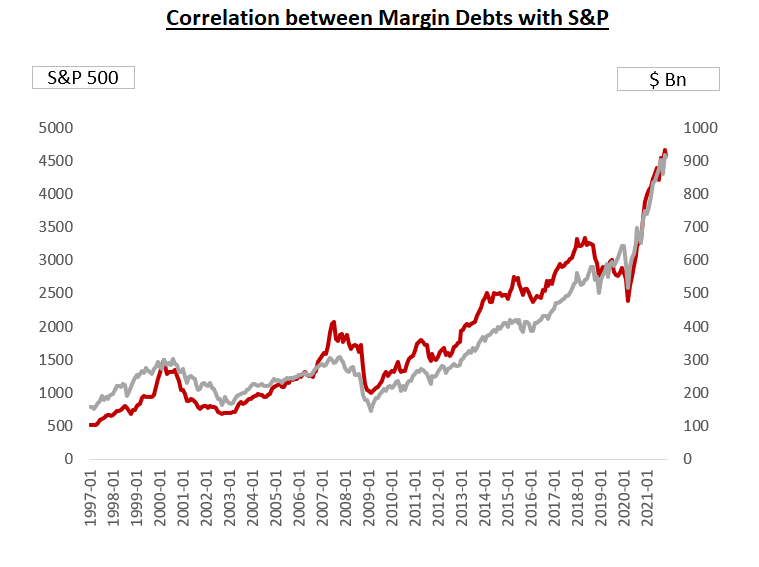

High customer margin debt

In 2021, we saw debit balances being highest in Customer’s Margin Accounts which means there was a lot of liquidity driven by margins in the markets which drove the markets higher. Investors are chasing higher returns by exposing themselves to higher risk.

As per the table under, whenever the margin debt has gone up (2000, 2008), S&P has corrected significantly. From January 2020 (pre-Covid) till November 2021, the margin debt has increased by 64%. Any fall in markets will lead to the unwinding of this debt and make the market fall further.

Source – FIRNA

However, we remain overweight on equities subject to expected earnings supporting the valuations of the businesses.