Private equity deal activity is moving at a scorching pace.

Driven by strong investor interest in business products and especially technology, PE deals are being completed at the fastest clip in at least 20 years

Following pent-up demand from a cautious 2020 driven by COVID-19 uncertainty, PE deals were expected to climb but the pace has been faster than anyone could have predicted

Not only has more money flowed directly to PE firms to invest, but firms have also benefited from an ample supply of credit from banks and other private investors to support buyout deals.

However, it is unlikely that the recent pace of dealmaking can be sustained for much longer.

First, PE firms would likely run out of capital to invest unless collective fundraising efforts pick up substantially.

Second, economic conditions appear to be shifting which may hamper dealmaking. In response to the highest inflation rate in 30 years, the Federal Reserve has signaled it will begin raising interest rates in 2022.

The incredible performance over the past year and a half has continued to push return expectations lower—a trend that was already apparent well before the pandemic occurred. Returns have likely been “pulled forward,” meaning that strong recent returns have come, in part, at the expense of future returns.

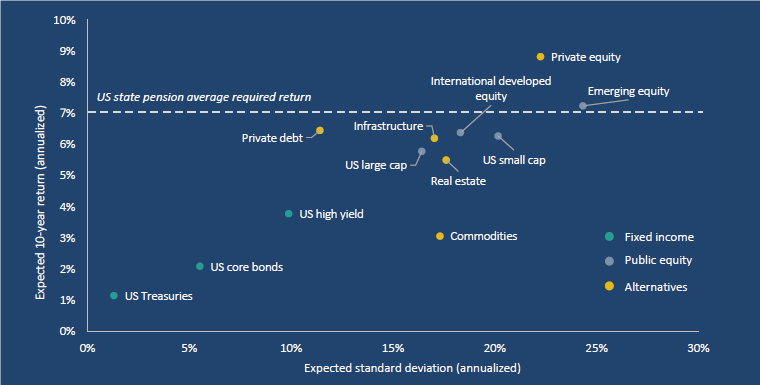

While institutional portfolios have benefited tremendously in recent periods from strong performance, meeting return targets over the next 10 years will be challenging. Only emerging market equity and PE have an expected return above the average US state pension’s return target. Investors will likely need to increase risk through direct leverage, shifting allocations, or both.

Source: Horizon Actuarial 2021 of Capital Market Assumptions Survey

Dealmaking activity in the energy sector has lagged all other sectors, but we expect a strong bounce back in this space if higher oil prices are sustained.

Propelled by an extremely hot IPO market, PE-backed exits have more than recovered from the slowdown in 2020

While the number of exits has been impressive, a sharp increase in companies’ valuations at exit has been the key factor behind the boom.

PE fund managers have reported record performance in the past five quarters even as distribution rates have been at average levels during this time.

Unrealized gains caused by valuation markups have contributed more to recent fund performance than during any period in at least 20 years

While fund distributions may surge in coming quarters if these high valuations are realized, there is a risk that future returns will be negatively affected—particularly if the exit market cools.