Inverting Yield Curve – Forerunner of a Recession?

There have been a lot of headlines around the bond market flashing warning signals about the growth prospects for the US economy which have prompted the investors in stock markets to panic.

The investors were already grappling with the geopolitical tensions between Russia and Ukraine and the hawkish Fed. Certainly, history suggests a correlation between inverted yield curves and recessions but this doesn’t mean that with only just one data point, a recession can be predicted.

What is Yield Curve Inversion?

Yield curves are generally upward sloping. Longer-dated bonds typically pay higher interest rates to compensate investors for the increased risk they assume over time.

An inverted yield curve means that the yield on longer dated bonds are lower than the yields on short dated bonds which means investors expect the yields on longer term bonds to not to be as high as they are today.

Recession Historically

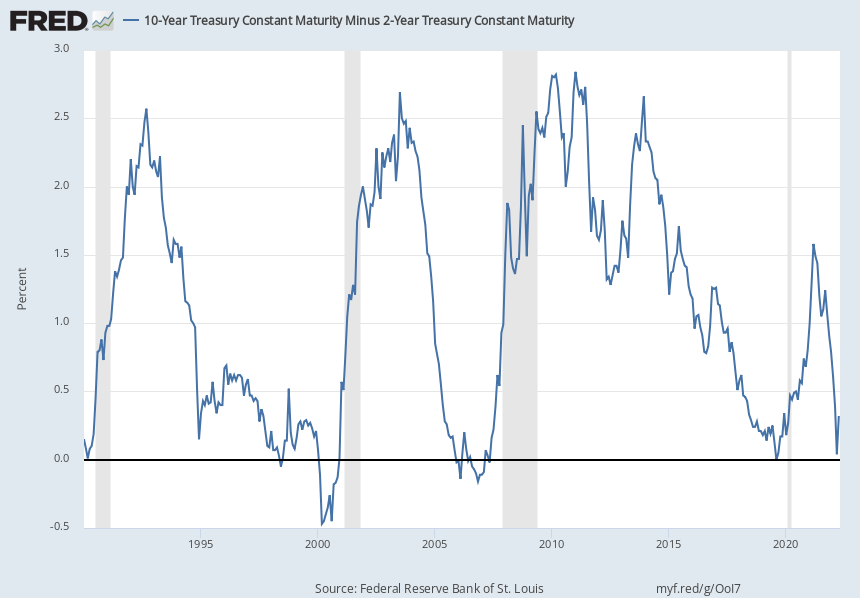

When we look at the chart below, we can see that when the 10yr – 2yr yield curve has remained inverted for a longer period of time, it was followed by a recession. Having said that, the time lag between the inversion and the actual recession has varied every time this has happened. For instance

- In 1965, the following recession didn’t hit until 1969, or 48 months later.

- The recession sparked by the busting of the tech bubble started in March 2001. But the yield curve inverted 34 months earlier, in May 1998.

The average time lag has ranged from 6 months to 3 years historically.

Also, other macro factors come in, play along with just the inverted yield curve to suggest that we may see a recession.

“It is different this time”

The 10-and-2 yield curve has inverted 28 times since 1900, and in 22 of those instances, a recession has followed which indicates that not every time the yield curve inverts it is followed by recession. Also, the yield curve has to remain inverted for a longer duration of time; an inversion of the curve for a brief period doesn’t necessarily mean anything.

Last time we saw the curve inverting in 2019, it was followed by a recession but we had Covid driven slowdown overlapping during that period. Therefore, to assess whether the inversion was a clear predictor or not is difficult.

Hence, as an investor, rather than considering one data point to decide on investment strategy the focus should be on fundamentals of individual stocks.

About Xanara

Xanara is a private banking and wealth advisory focused on developing and implementing transparent and client-centric, financial solutions that are backed by expertise. We understand the weight of our solutions and act with the utmost care, resilience, and most importantly, integrity.