Author: Harshita Bhonsle, Investment Analyst at Xanara

A correction in S&P500, or even the thought of it striking in the near future, is bound to make investors panic. However, it’s essential to understand that corrections are a part of market dynamics and investors shouldn’t let panic take over.

Instead, investors should prepare if there’s an impending correction.

In September 2021, we witnessed a ~5% correction in the S&P500 index after which the markets rebounded. The last time we saw such a correction in the index was in March 2020.

So, it’s imperative that investors will ask themselves if S&P500 is overvalued.

Evaluating S&P500

One way to evaluate the valuations is by calculating the P/E ratio (price/earnings). However, the P/E ratio uses 12 months trailing or forward earnings which leads to the ratio being skewed.

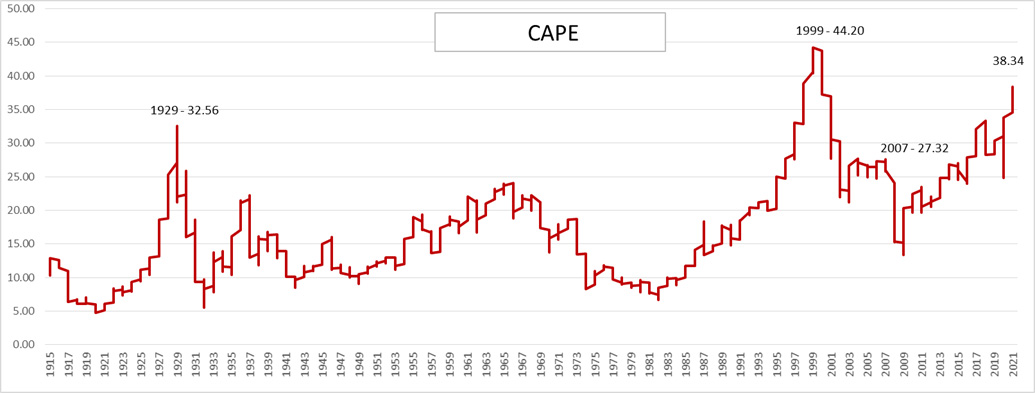

Therefore, the Shiller P/E ratio or Cyclically Adjusted PE (CAPE) is used instead of the P/E ratio. This ratio calculates PE based on the cyclically adjusted earnings for 10 years which smoothens variations in earnings across business cycles.

Currently, CAPE is at 38 and S&P has been more expensive only once (1998-2000) in the last 100 years.

Source: Online data Robert Shiller, Yale

Source: Online data Robert Shiller, Yale

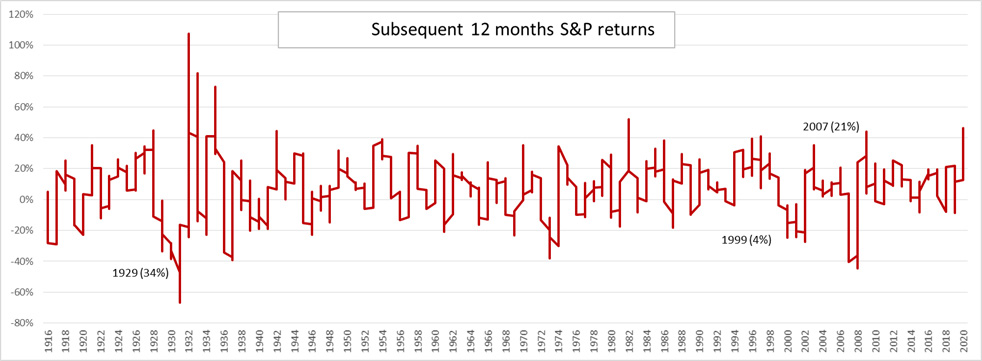

Most of the times when Shiller PE has gone above 30, S&P500 returns for the subsequent 12 months have been lower than their average historical returns. The last time S&P500 was more expensive than current levels, there was a ~41% correction which lasted over 2 years.

Shiller P/E may not be an exact indicator for entry or exit but it helps evaluate the expected returns for S&P500 in the future.

Other headwinds along with high CAPE are:

- QE unwinding by FED may negatively impact the liquidity in the economy

- Rate hikes starting in 2022 may impact the valuations of most companies

- Increasing input prices may put downward pressure on the margins

All of this, coupled with the fact that S&P500 is currently near its all-time high, indicates that a correction may be due in the coming few months.

So, it’s crucial for investors to keep an eye on and prepare for the correction, not panic at the thought of it.