Resilience Amid Shifting Leadership

November 2025 was a month characterized by resilience and a notable shift in market leadership, ultimately extending the overall equity market gains for the year. After a brief wobble early in the month, the market regained momentum, benefiting from supportive economic fundamentals, fading recession fears, and the expectation of continued monetary policy easing.

I. Equity Market Performance and Technical Backdrop

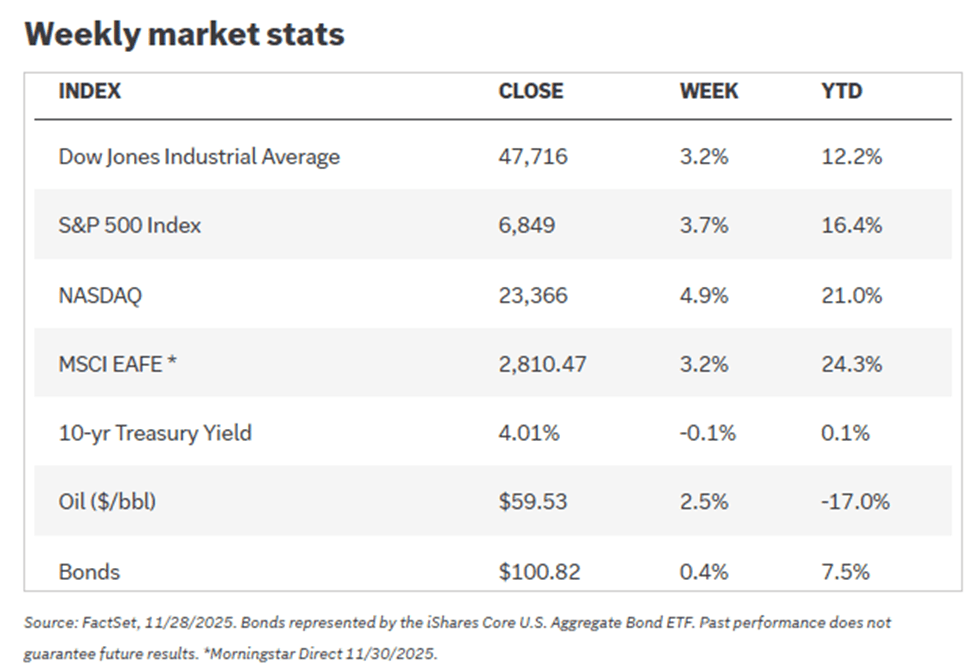

The U.S. equity market continued its upward trajectory, though performance was uneven across indices:

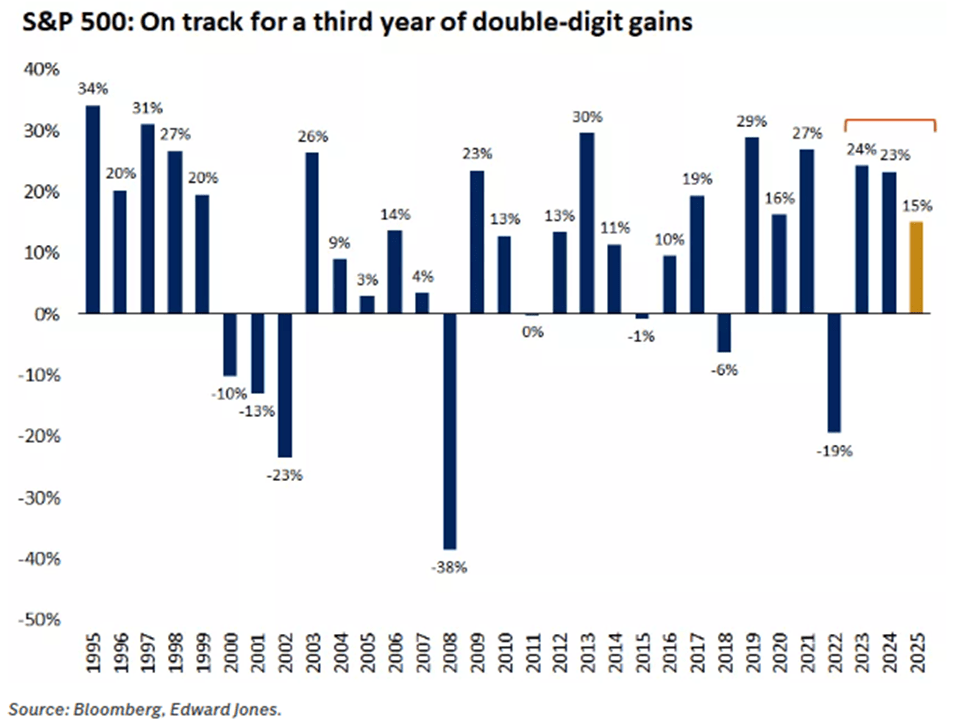

- S&P 500 Finish: The S&P 500 finished the month with a slight gain (approximately 0.2-0.3%). This performance helped confirm the historically supportive post-Thanksgiving seasonal trends, which typically point to a strong year-end finish (December has averaged about a 1% gain over the past 30 years).

- Sector Rotation and AI: Market leadership broadened beneath the surface, a key development for the month.

- The tech-heavy Nasdaq 100 underperformed, driven by profit-taking and valuation concerns in the AI-related segment.

- The market showed significant strength outside of the largest technology names, with the S&P Midcap 400 and S&P 500 equal-weight indices outperforming (gaining around 1.9% to 2%).

- Value stocks significantly outperformed Growth stocks, and previously lagging sectors like healthcare saw notable advances, highlighting a shift toward broader market participation.

Corporate Fundamentals: Profits as the Primary Driver

The economic environment remained a solid backdrop for corporate earnings:

- Profit Growth: U.S. large-cap companies continued to significantly outperform GDP growth. S&P 500 profits are on track to rise approximately 11% year-over-year for 2025, with profit margins holding near record highs.

- Tariff Impact: Companies effectively offset the challenge posed by tariffs (which absorbed an estimated 70% of the added costs) through cost-cutting, supply-chain adjustments, and productivity gains.

- 2026 Outlook: With limited room for further valuation expansion, earnings growth will remain the primary driver of stock prices next year. Consensus currently calls for robust 14% earnings growth in 2026.

II. Fixed Income and Monetary Policy

The fixed income market was supported by the ongoing Fed easing cycle and moderating inflation.

- Fed Policy: After a period of policy debates, the Federal Reserve’s pivot toward a less restrictive stance resumed its easing cycle this year. Expectations for the future path of the Fed funds rate point to a continued cautious easing trend through 2026, which is providing support for economic growth and financial markets.

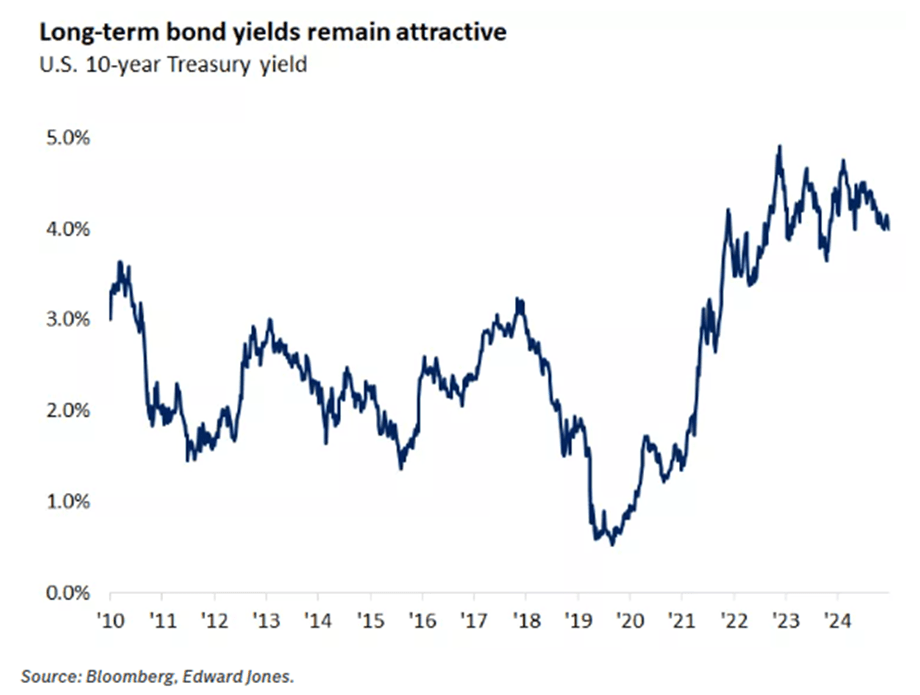

- Treasury Yields: The 10-year Treasury yield retreated further, poised to finish the year near the lower end of its two-year range, around 4.0% (down from its 4.8% peak earlier in 2025). This helped ease financial conditions, notably bringing the average 30-year mortgage rate down from 7.1% to 6.4%.

- Income Opportunity: Despite the recent pullback, yields remain historically attractive, near their highest levels in 15 years, offering bond investors income that exceeds inflation. Anticipated solid bond returns in 2026 are expected to be driven primarily by this high-income component.

III. Economic Conditions and Inflation

Recession fears continued to fade as economic activity remained surprisingly firm.

- Economic Resilience: Economic resilience continued in 2025. Activity rebounded strongly in the second and third quarters, supported by solid consumer spending and AI investments.

- Consumer Dynamics: A disconnect persisted between sentiment and behaviour. While consumer confidence remained subdued (exacerbated by the recent government shutdown), spending held up, concentrated among wealthier households that benefited from significant stock-market gains. Forecasts point to a robust holiday season, with retail sales projected to rise about 4% from last year, surpassing $1 trillion for the first time.

- Inflation Relief: Overall headline CPI is decelerating modestly, from 3% in 2024 to 2.7% so far in 2025. This relief was aided by lower commodity prices, specifically WTI oil prices, which averaged $65 per barrel this year (down from $76 last year). Services inflation continued its gradual decline, offsetting some upward pressure from tariffs on goods prices.

IV. Closing Thoughts: Resilience and Optimism for 2026

As 2025 concludes, markets have demonstrated a powerful theme: resilience. The drivers strong equity gains, fading recession fears, innovation, and attractive income opportunities underscore the importance of staying invested and disciplined.

We believe 2026 offers a constructive backdrop. While elevated valuations will require vigilance, the combination of steady growth, lower interest rates, and rising corporate profits provides significant reasons for optimism and suggests portfolios should be positioned for continued resilience and growth in the year ahead.

Source: BBG, Edward Jones