Executive Summary

September 2025 was a pivotal month for global financial markets, driven by monetary policy shifts, macroeconomic data, and geopolitical developments. U.S. equities surged, led by technology and AI sectors, following a Federal Reserve rate cut. Commodities recorded selective gains, cryptocurrencies remained resilient, and fixed income markets displayed mixed trends. Globally, Europe and Japan showed moderate growth, whereas India faced capital outflows amid external pressures. Trade tensions, regulatory measures, and inflation remained key influencers across all major regions.

United States – A Strong Equity Rally Amid Rate Cut

Equity Market Performance

| Index | Closing Level | Monthly Change (%) |

| S&P 500 | 4,500 | +3.5% |

| Nasdaq 100 | 15,200 | +5.6% |

| Dow Jones | 36,800 | +1.9% |

| Russell 2000 | 2,320 | +4.2% |

Market Callout: “The Fed’s 25bps rate cut bolstered investor sentiment, particularly in technology and AI sectors.”

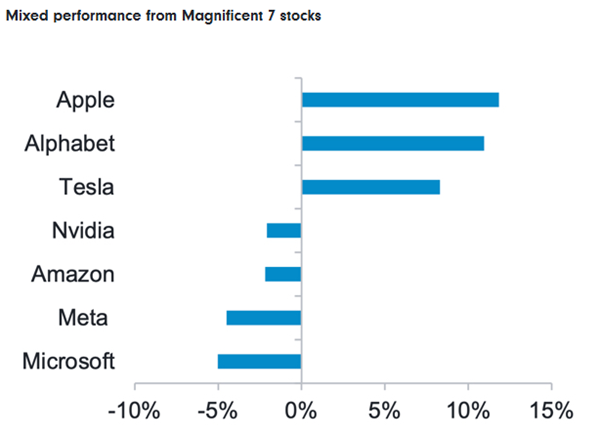

September saw U.S. equities recover strongly. The S&P 500 gained 3.5% while the Nasdaq soared 5.6%, driven by megacap technology and AI-focused stocks. The Dow Jones rose 1.9%, reflecting optimism across large-cap sectors, and the Russell 2000 demonstrated broad-based market confidence.

The Federal Reserve’s decision to cut the federal funds rate to 4.0–4.25% supported equity markets by encouraging risk-on sentiment. Strong consumer spending and stable employment reinforced economic resilience. Meanwhile, U.S. trade and regulatory policy remained influential. Newly imposed tariffs on heavy trucks and furniture imports, alongside the “TrumpRx” program allowing direct-to-consumer pharmaceutical purchases at discounted prices, affected healthcare and industrial sectors.

Fixed Income and Commodities

| Asset | Performance | Notes |

| 10Y Treasury Yield | ~3.5% | Stable amid rate cut |

| Investment-Grade Bonds | Slight underperformance | New issuance weighed on prices |

| High-Yield Bonds | Outperformance | Benefited from risk-on sentiment |

| Gold | +2.5% | $1,950/oz; safe-haven demand |

| Silver | +7.9% | Strong investor inflows |

| Crude Oil | +4.5% | Supply constraints & geopolitical tension |

| Bitcoin | +1.0% | $114,500; stable gains |

| Ethereum | -0.5% | $4,140; minor pullback |

Europe – Steady Gains Amid Policy Caution

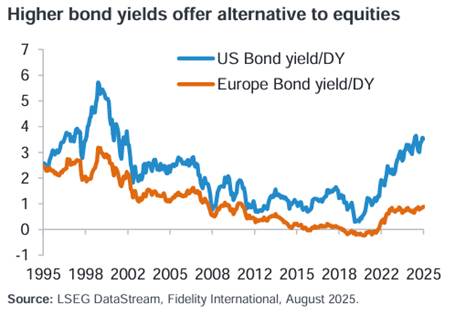

European markets advanced moderately, with the Stoxx Europe 600 rising 1.5%, marking its strongest September in six years. Healthcare and defensive sectors led the gains. The European Central Bank maintained interest rates, highlighting cautious optimism given slower growth and moderate inflation pressures. Concerns were raised over potential risks from easing bank securitization rules, reflecting ongoing vigilance regarding financial stability. Eurozone GDP forecasts were revised downward amid weaker industrial activity.

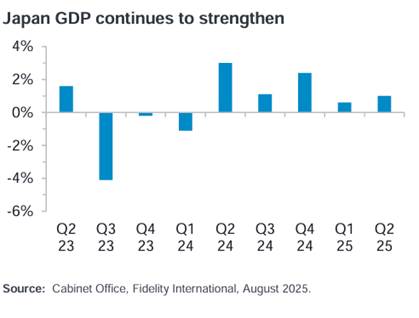

Japan – Equities Climb Despite Industrial Weakness

Japan’s Nikkei 225 reached an all-time high of 45,870, driven by strong corporate earnings and fiscal support. However, industrial activity slowed, with the manufacturing PMI falling to 48.5, signaling contraction. The Bank of Japan maintained its ultra-loose monetary policy, while some board members debated the possibility of a near-term rate hike, underscoring the delicate balance between market support and economic fundamentals.

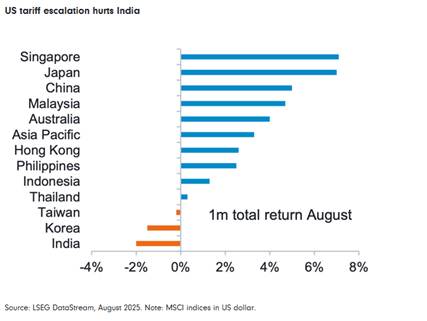

India – Capital Outflows and Domestic Resilience

India experienced foreign institutional investor outflows of $2.7 billion in September, marking the third consecutive month of net withdrawals. The IT sector bore the brunt, losing $7.2 billion due to U.S. visa policy changes and global trade concerns. Despite this, domestic manufacturing remained expansionary, with a PMI of 57.7, albeit reflecting slower growth and rising input costs. The new trade agreement with the European Free Trade Association (EFTA) aims to boost exports and attract foreign investment, while potential rate adjustments by the Reserve Bank of India are expected to support economic stability.

Macro Highlights

September underscored the influence of monetary policy, trade measures, and geopolitical factors:

- U.S. Federal Reserve: Rate cut of 25bps to 4.0–4.25%, aiming to sustain employment and moderate inflation.

- Trade Policy & Regulation: New tariffs on imports and the TrumpRx program impacted sectoral performance, particularly healthcare and industrials.

- European Central Bank: Maintained interest rates, cautioning on financial stability risks.

- Bank of Japan: Continued accommodative stance, balancing equity support with industrial contraction.

- India: Domestic policies and trade agreements sought to mitigate foreign outflows and sustain growth.

Outlook

The global markets entered October 2025 with cautious optimism. U.S. equities and technology sectors remain well-supported by accommodative policy, but trade tensions and regulatory uncertainties continue to influence investor behavior. Europe and Japan display selective strength, while India navigates external pressures against a backdrop of resilient domestic growth. Commodities provide safe-haven opportunities, and cryptocurrencies continue to attract measured interest. Monitoring central bank actions, geopolitical developments, and trade dynamics will be critical for navigating the final quarter of 2025.