Market Overview

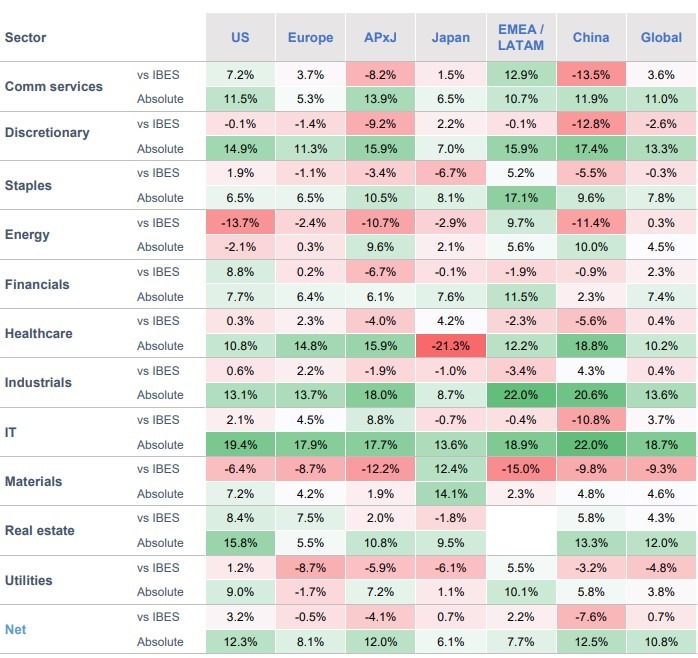

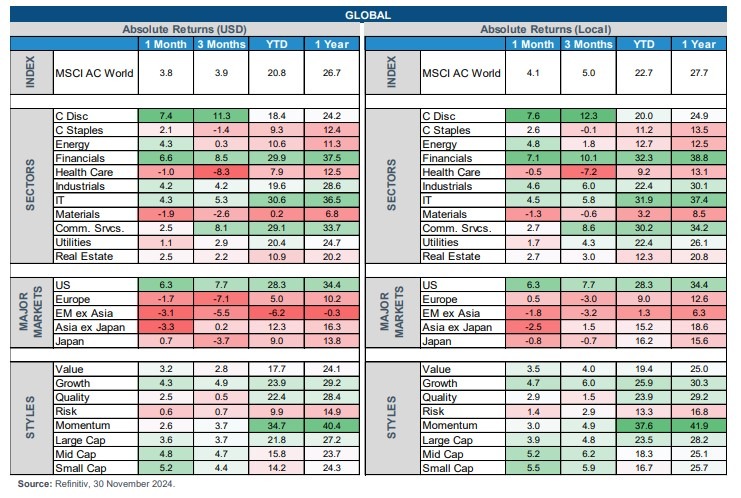

U.S. equities extended their rally in December 2024, cementing the fed rate decision and the favourable movements of the economic indicators following the Republican clean sweep in the presidential election. The decisive result alleviated political uncertainties, fostering a supportive environment for growth and earnings. The S&P 500 climbed 5.9% for the month, while the Russell 2000 Index surged 11.0%, underscoring optimism around domestic-focused, smaller-cap companies expected to benefit from pro-business policies. This performance contrasts sharply with non-U.S. equities, which faced challenges including tariff concerns, geopolitical tensions, and slowing exports to China. Developed markets (MSCI EAFE Index) dipped by 0.6%, while emerging markets (MSCI EM Index) fell 3.6%.

Valuations in the U.S. remain elevated, with trailing price-to-earnings ratios at historic highs. Analysts caution that while U.S. equity growth has been bolstered by AI adoption and home-shoring trends, these benefits may increasingly require discerning investments as fiscal and monetary policies evolve. Globally, regions like Japan and parts of ASEAN present attractive opportunities amid divergent performances and sectoral shifts.

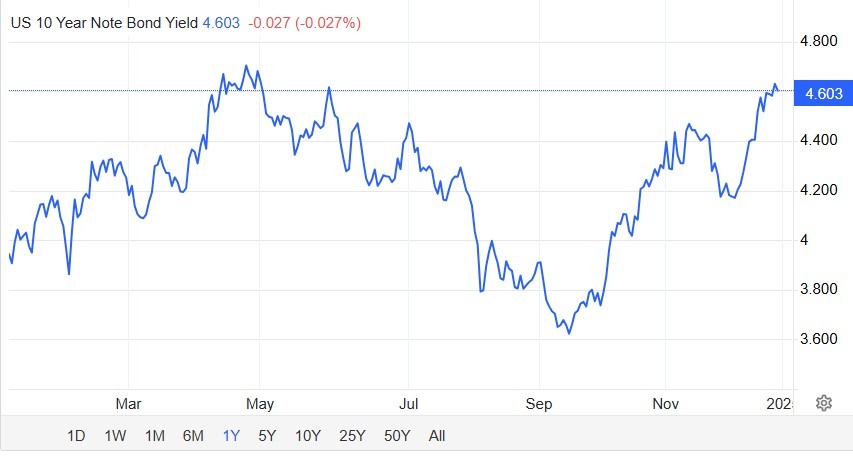

Fixed Income Markets

The bond market delivered significant mark to market losses in December, buoyed by a steeper increase in Treasury yields driven by rate cuts by the Fed which made the Bloomberg U.S. Aggregate Bond Index rise 1.1% to 4.6%. Long-term bonds outperformed short-term peers, benefiting from investor optimism around the new administration’s potential fiscal initiatives. Investment-grade corporate bonds edged out high-yield bonds, returning 1.3% compared to 1.2%, as credit spreads continued to narrow to multi-decade lows.

Globally, the fixed income narrative varied. Japan’s normalization of interest rates, including multiple hikes in 2024, has bolstered the outlook for domestic banks while raising the costs of export-led industries. Meanwhile, European bonds faced headwinds from political instability and mixed signals from the European Central Bank, which remained cautious about aggressive monetary easing.

Federal Reserve Actions

The Federal Reserve reduced the policy rates by 25 bps in December setting its range at 4.25%-4.50%, signalling a slower pace of future rate reductions in 2025. Strong labor market conditions and moderate inflation supported this stance whereas the focus is primarily on Inflation statistics as per the Fed Chair Jerome Powell. The Fed aims to achieve a “soft landing” for the economy, balancing growth with inflation containment.

Economic Indicators

Economic activity remained robust in the U.S., with Q3 GDP growing at an annualized rate of 2.8%, driven by strong consumer spending and government investment. Retail sales in December exceeded expectations, rising 0.4%, and revisions to prior months indicated further strength. While job creation slowed, partly due to temporary disruptions such as strikes and hurricanes, unemployment held steady at 4.1%. Initial jobless claims dropped, suggesting resilience in the labour market.

Inflation edged slightly higher in November, with the Consumer Price Index (CPI) rising to 2.7% year-over-year, up from 2.6% in October, as expected. Core inflation, excluding volatile food and energy prices, remained steady at 3.3% annually. These inflation dynamics align with the Federal Reserve’s cautious monetary stance, reinforcing expectations for a gradual policy adjustment to avoid overheating the economy.

Global Market Themes

Outside the U.S., Japan’s equity market faced challenges from geopolitical tensions and currency fluctuations, despite domestic economic reforms and monetary tightening. The Bank of Japan’s policy normalization, including higher interest rates, has bolstered financials while creating headwinds for export-reliant sectors. European equities struggled amid political instability in key economies like Germany and France, compounded by concerns over U.S. trade tariffs and regional growth.

Emerging markets were broadly pressured, with Latin America and Asia-Pacific underperforming due to weak commodity prices, trade tensions, and currency depreciation. China showed signs of stabilization with improved retail sales and manufacturing activity, though scepticism persists regarding the sufficiency of recent stimulus measures.

December 2024 highlighted the stark contrasts in global markets, with U.S. equities standing out amid favorable macroeconomic conditions and robust policy support. While international markets grappled with a mix of challenges and opportunities, the U.S. maintained its lead as a beacon of economic resilience. As investors look ahead to 2025, the evolving landscape of fiscal and monetary policies, alongside regional divergences, will require careful navigation to identify opportunities while managing risks.