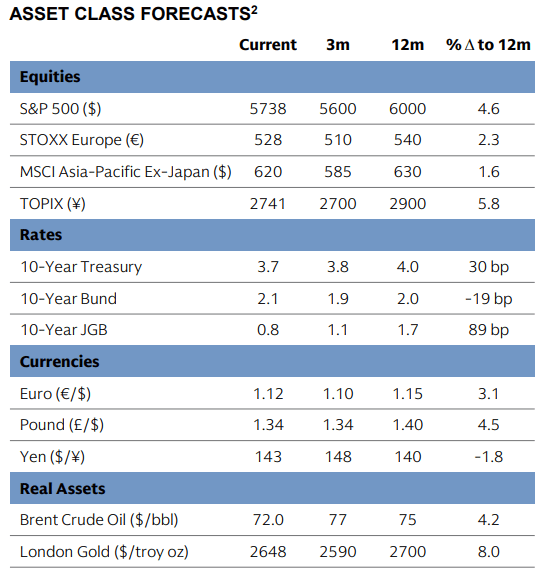

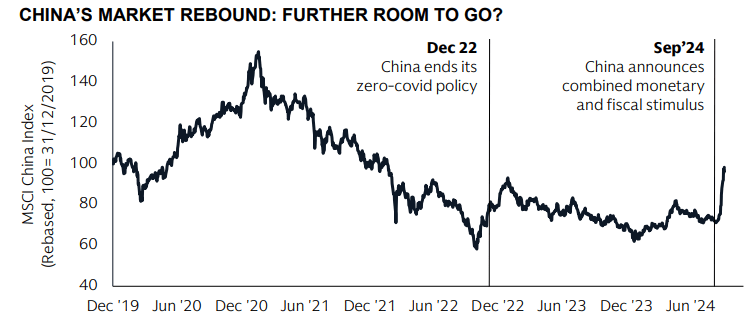

In October, global markets showed modest gains, largely driven by emerging markets, as China introduced substantial new stimulus measures that strengthened investor confidence and lifted Chinese stocks. In the U.S., the S&P 500 rebounded from early losses, ending the month with a positive return as investors anticipated a potential easing in monetary policy.

Equity Markets: Large Caps and Emerging Markets Lead Investors leaned toward large-cap stocks for their stability, with the S&P 500 gaining +2.1%, outpacing the +0.7% return of small caps. Concerns about a slowing U.S. economy contributed to this shift, and dividend-paying sectors, especially Utilities and Real Estate, led third-quarter returns as Treasury yields fell. Meanwhile, energy stocks faced challenges as oil prices softened, with U.S. inventories rising and OPEC preparing to lift production cuts.Emerging markets outperformed developed markets, as the MSCI EM Index climbed +6.7%. This rise was driven by a robust +23.9% gain in Chinese stocks, boosted by China’s largest stimulus package since the pandemic. While this has sparked optimism in China’s resilience, the need for a separate strategy for China within the broader EM approach has become more apparent.

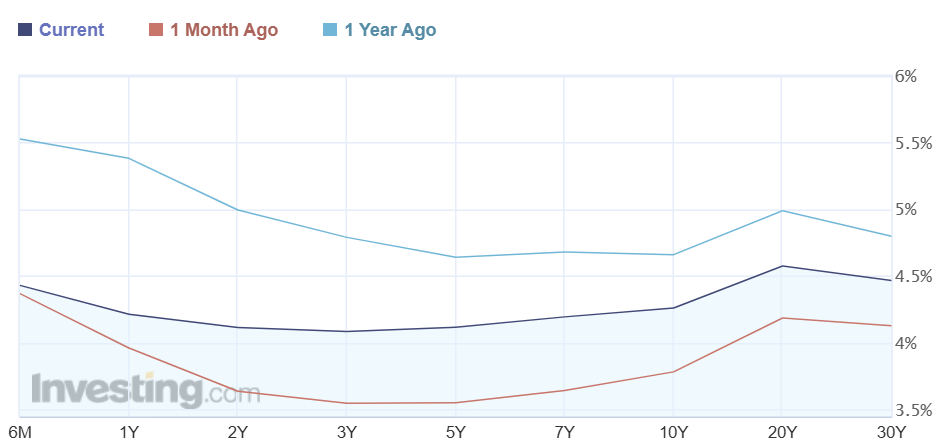

Fixed Income: Declining Yields and Yield Curve Normalization Fixed income markets posted a fifth straight month of gains in October, with the Bloomberg U.S. Aggregate Bond Index up +1.3% as interest rates eased amid slowing economic growth. The 10-year U.S. Treasury yield decreased from 3.91% to 3.81%, while short-term rates saw the steepest declines on the prospect of further rate cuts by the Federal Reserve, causing initial signs of yield curve normalization.

Investment-grade corporate bonds led fixed income returns, benefiting from lower yields and tightening credit spreads. The demand for high-quality corporates remains high as issuance approaches record levels, making core fixed income attractive as rates continue to fall.

Federal Reserve Policy: A Shift Toward a Dovish Stance The Federal Reserve’s September rate cut of 50 basis points—the first since 2020—reflects its growing confidence in inflation easing, even as the labor market shows signs of softening. This larger-than-expected cut reinforces the Fed’s commitment to a “soft landing,” a move that has boosted risk assets such as equities. However, if the Fed’s efforts fall short, defensive assets may be better positioned to perform. The Fed’s latest projections indicate modestly higher unemployment but a stable growth outlook, with more monetary easing anticipated in 2025.

Recession Watch: Sahm Rule Alert Amid Consumer Resilience The U.S. unemployment rate’s increase from 3.7% to 4.2% triggered the Sahm Rule—a widely watched recession indicator activated by a 0.5% rise in unemployment above its 12-month low. Despite this signal, many analysts believe a recession can still be avoided, citing strong consumer spending and potential stability in the job market. Retail sales have also been resilient, surpassing expectations and highlighting the consumer’s vital role in maintaining economic stability.

Global Economic Trends: China Stimulus and Eurozone Headwinds China’s recent easing measures have driven a significant rally in Chinese stocks, although the economy still faces structural challenges. These policy shifts suggest that investors should consider separating their China investments from broader EM allocations to capture more targeted growth in the region.

In the Eurozone, growth remains sluggish, with low PMI readings, cautious consumer sentiment, and weak industrial activity. However, economists project a moderate growth recovery in 2025, supported by high consumer savings and a more accommodative policy stance.

Oil Market: Supply and Demand Shifts Amid Geopolitical Tensions: Global oil demand is expected to grow by just under 900,000 barrels per day (kb/d) in 2024 and around 1 million barrels per day (mb/d) in 2025, marking a sharp slowdown compared to the post-pandemic surge of 2 mb/d in 2022-2023. This deceleration is largely driven by lower demand from China, which is now contributing roughly 20% of global growth—down from 70% in 2023. Global oil supply dropped by 640 kb/d in September to 102.8 mb/d due to disruptions in Libya and maintenance work in Kazakhstan and Norway. Despite a recent rise in Brent crude prices fueled by geopolitical concerns in the Middle East, a well-supplied global market and high OPEC+ spare capacity are likely to moderate price spikes unless major supply disruptions arise.

Outlook The economic landscape remains fluid as central banks hint at a shift to more accommodative policies, potentially setting the stage for a series of rate cuts. In this environment, opportunities may continue to emerge in high-quality bonds, select equities, and sectors poised to benefit from easing inflation and interest rate pressures. The resilience of U.S. consumers, the Fed’s soft-landing approach, and focused strategies for emerging markets like China will be key areas to watch.