Asset Classes

Equity Markets

July 2024 experienced notable volatility due to mixed economic and political factors. Softer-than-expected US inflation and labour market data heightened expectations for Federal Reserve rate cuts, driving a shift towards small-cap stocks and interest-sensitive assets. Small-cap equities surged by 6.9%, significantly outperforming broader developed equities, which saw a 1.8% rise in the MSCI World Index. Growth stocks, particularly in AI, declined by 1.0% amid reduced investor enthusiasm. However, year-to-date performance for growth stocks remains strong, contributing to a 14% gain in developed market equities.

Regional performances varied. The US S&P 500 increased by 1.2%, buoyed by resilient earnings, though technology stocks faced pressure before a late month rebound. Small-cap stocks outperformed large-cap stocks, marking the largest one-month outperformance of the Russell 2000 versus the Nasdaq 100 in over two decades. The UK’s FTSE All-Share rose by 3.1% due to robust service sector PMIs and stronger-than-expected economic growth. European equities lagged, with the MSCI Europe ex-UK returning just 0.6%, impacted by disappointing PMI data and political uncertainties in France. Japanese equities, as measured by the TOPIX index, fell by 0.5% due to a strengthening yen and global tech stock weakness. Chinese equities also struggled, with the MSCI China Index down by 1.2% amid real estate sector challenges despite government stimulus.

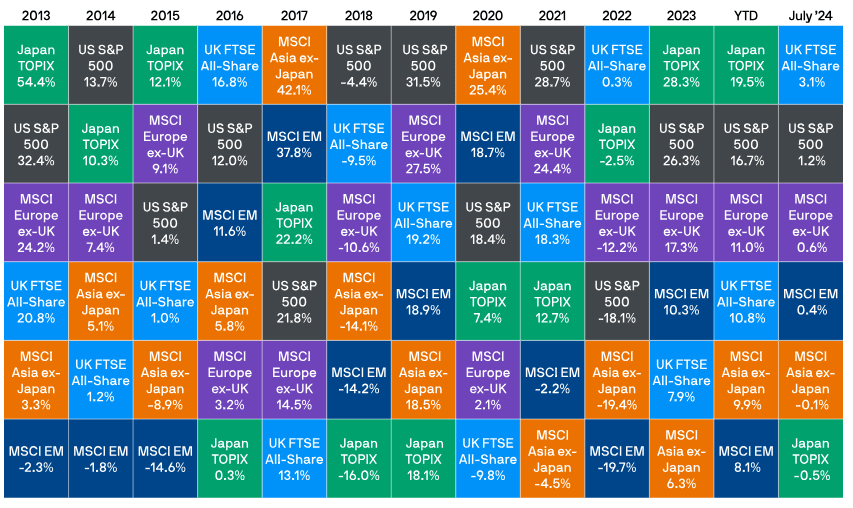

Figure 1 World stock market returns

Fixed Income

In fixed income markets, US Treasuries gained 2.2%, supported by expectations of Fed rate cuts. The yield curve steepened, with the spread between the 10-year and 2-year US Treasury yields narrowing to -21 basis points. UK Gilts underperformed with a return of 1.9% due to stronger-than-expected GDP growth and persistent inflation suggesting a slower pace of rate cuts compared to the US. In the eurozone, peripheral bonds, such as Italian and Spanish sovereign bonds, outperformed core bonds with returns of 2.8% and 2.3%, respectively. Japanese Government Bonds (JGBs) remained flat following policy adjustments, including a rate hike and reduced bond purchases.

Investment grade bonds outperformed high yield bonds. The Bloomberg Global Aggregate Corporate Index, tracking developed market investment-grade bonds, returned 2.4% for the month. In comparison, US high yield bonds returned 2.0%, while European high yield bonds returned 1.2%.

Commodities

The Bloomberg Commodity Index declined by 4.0% in July, primarily driven by falling oil prices as the market weighed weaker demand from China against ongoing supply issues in the Middle East.

Macro Overview

United States

US equities gained in July due to easing inflation and robust economic data. The Federal Reserve kept rates unchanged, supporting a “soft landing” for the economy. Inflation moderated to 3.0% annually, and Q2 GDP growth was 2.4%. Sector performance was mixed; energy, media, technology, and banking stocks performed well, while healthcare and consumer staples lagged.

Eurozone

Eurozone stocks advanced as inflationary pressures eased, and economic growth remained steady. The European Central Bank raised rates by 25 basis points, signalling the potential end of the current cycle. Inflation fell to 5.3%, and the economy grew by 0.3% in Q2. While some sectors, like banking, saw positive earnings, others, such as food and beverage, struggled with higher prices.

United Kingdom

UK equities rose due to expectations of fewer future rate hikes by the Bank of England, following a drop in inflation to 7.9%. Lower gilt yields positively impacted mortgage-sensitive sectors. Economic indicators were mixed, but housing, real estate, and basic materials saw improvements due to favourable commodity prices.

Japan

Japanese equities showed modest growth, with the TOPIX index rising by 1.5% while the Nikkei 225 dipped slightly. Market movements were influenced by profit-taking and anticipation of Bank of Japan policy decisions. Positive US economic performance supported Japan’s market, despite concerns over potential monetary policy tightening.

Asia ex-Japan

Equities in Asia ex-Japan performed strongly, led by China, Malaysia, and Singapore. China’s new economic stimulus measures and robust tourism data in Singapore drove gains. Taiwan and South Korea also saw positive returns, driven by interest in AI and tech sectors. The region benefited from favourable economic policies and investor sentiment.

Emerging Markets

Emerging markets outperformed developed markets in July, supported by China’s economic stimulus and strong commodity prices. Turkey, Colombia, and South Africa performed well, while Brazil, Mexico, and India faced challenges from weaker economic indicators and high inflation. Overall, emerging markets showed resilience with notable gains.

Overall, July 2024 was marked by diverse asset class performances driven by positive economic data and policy adjustments across global markets.