Improved Investment Climate

September 2024 marked a significant shift in the investment landscape, characterized by a decrease in inflation and central banks lowering interest rates. This environment has created enhanced opportunities for investors looking to build diversified portfolios, a welcome change following the post-COVID turbulence.

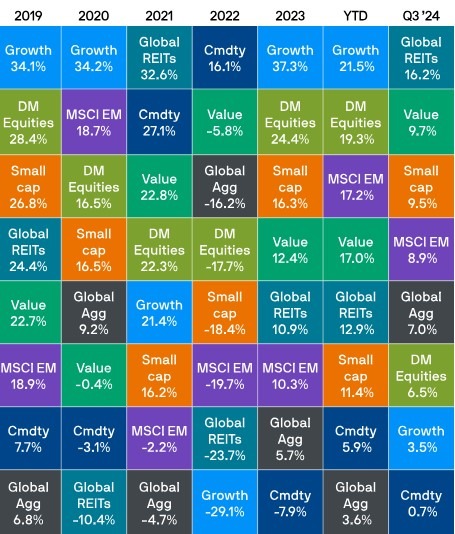

Resilient Performance Amidst Volatility

Despite experiencing several bouts of market fluctuations throughout the month, major asset classes posted solid returns. Early August saw a downturn due to weaker US economic data, an interest rate hike from the Bank of Japan, and limited summer trading volume. However, the long-anticipated initiation of the Federal Reserve’s rate-cutting strategy in September, combined with a more dovish stance from Japanese policymakers and new stimulus measures in China, alleviated investor concerns and fuelled a robust stock market rally as the month progressed.

Equities Show Strong Returns

Developed market equities gained 6.5% in September, with sectors previously affected by high-interest rates, such as small-cap stocks and global REITs, leading the way with returns of 9.5% and 16.2%, respectively. Although growth stocks pulled back slightly, they remain up over 20% year-to-date.

Fixed Income Gains Momentum

The fixed-income market benefited from the prospect of declining rates, with the Barclays Global Aggregate index rising by 7.0% in September. Both government bonds and credit performed well, while emerging market debt surged by 6.1%, establishing itself as a top performer in the fixed-income category this year.

Commodities Underperform

In contrast, commodities delivered relatively muted returns, rising just 0.7% for the month. Concerns regarding global economic health led to a 17% drop in Brent Crude oil prices, although gold reached new all-time highs, highlighting contrasting trends within the commodity market.

Federal Reserve Takes Action

Interest Rate Cuts Begin

September marked the beginning of the Federal Reserve’s rate-cutting cycle after a 14-month hiatus, with a 50-basis point reduction announced during the month. The unemployment rate, which had climbed from a low of 3.4% in April 2023 to 4.2%, prompted Fed officials to express a desire to prevent further economic weakening and move rates back to more manageable levels. This cautious approach was further validated by the largest monthly decline in consumer confidence in over three years.

Market Expectations Shift

A comparison of interest rate forecasts from the beginning of September demonstrates a significant shift in investor expectations. On June 30, market projections anticipated US rates would reach 4.4% by mid-2025, but by the end of September, expectations adjusted to a more favorable outlook of 3.2%.

Other Central Banks Follow Suit

With inflation easing, other western central banks also opted for rate cuts. The European Central Bank announced its second-rate reduction in September, lowering rates to 3.5%, while the Bank of England began its own easing cycle with a 25 basis point cut in August.

Fixed Income Market Highlights

The positive shift in interest rate expectations resulted in strong performance for government bonds, with US Treasuries yielding a return of 4.7% and European sovereigns achieving 4.0%. However, UK Gilts lagged slightly with a return of 2.4% due to ongoing elevated wage growth in a tighter labor market.

Credit Sector Recovery

The credit sector also delivered strong returns, with investment-grade credit spreads narrowing and generating a 6.3% return for the month, bringing year-to-date performance back into positive territory. High-yield spreads also tightened, resulting in returns of 5.3% in the US and 3.5% in Europe.

Regional Equity Performance

Asia Ex-Japan Leads the Pack

Asia ex-Japan was the top-performing major region in September, achieving an impressive 10.6% return. Stocks rallied strongly towards the month’s end following new stimulus measures announced by Chinese policymakers, signaling a coordinated effort to support the economy.

Japan Faces Challenges

Conversely, Japanese stocks struggled, declining by 4.9% amid the Bank of Japan’s rate hike and subsequent narrowing of interest rate differentials. Although a more reassuring tone from BoJ officials later helped mitigate losses, the market ended the month in the red.

Mixed Results in Europe and the US

European equity markets experienced muted returns, with the UK and Europe ex-UK returning 2.3% and 1.6%, respectively. Economic data highlighted the sluggish eurozone recovery, particularly impacted by weak demand from China.

The S&P 500 continued its upward trajectory, posting a return of 5.9%. Encouragingly, there were signs of broader market recovery, as US value stocks outperformed growth stocks by 7 percentage points, with small-cap stocks rallying in anticipation of lower interest rates.

Conclusion: A Promising Outlook

September’s strong performance across various asset classes positions many financial markets for double-digit year-to-date returns. The shift in stock/bond correlations presents opportunities for multi-asset investors. With inflation under control and central banks prepared to support economic growth through lower interest rates, the potential for resilient portfolios is greater than it has been since the pandemic. However, with potential volatility on the horizon—particularly as we approach the November US elections—investors should remain vigilant and adaptable in their strategies.