GLOBAL MACRO OVERVIEW

Earnings

Last month’s earnings have been encouraging, with roughly two-thirds of S&P 500 companies beating consensus EPS estimates by an average of 9%. Despite heightened macro uncertainty, earnings growth and micro factors remain key drivers of equity prices, as evidenced by large valuation premiums assigned to companies with quality attributes and strong balance sheets.

Rates

The European Central Bank (ECB) is set to cut interest rates, diverging from US policy, as it embraces a widening gap in borrowing costs. The decision comes amid reports of lingering consumer-price pressures and potential currency depreciation risks. Bank of Italy Governor Fabio Panetta acknowledges currency risks but emphasizes potential adverse effects of tight US policy on global demand and Eurozone inflation. Denmark’s central bank is anticipated to follow suit with a rate cut. Meanwhile, upcoming US payrolls data and the Bank of Canada’s decision on a possible rate cut will be closely monitored.

Inflation

US core PCE inflation has re-accelerated to a 3.7% pace in Q1 2024, up from 1.9% in H2 2023. GIR expects this pace to slow to 2.1% on average for the rest of 2024, reflecting further rebalancing in housing and labor markets. In the Euro area, core inflation is expected to slow further to 2.3% YoY by year-end.

Growth

US real GDP rose 1.6% annualized in Q1, below GIR’s expectations, driven by variable categories such as inventories and foreign trade. GIR continues to expect firm real GDP growth of 2.9% YoY in 2024. In the Euro area, growth may recover due to falling inflation, labor market strength, easing financial conditions, and increased corporate investment, with GIR forecasting a growth rate of 0.8% YoY in 2024.

Politics

The US presidential election has garnered significant attention, with important Senate and House races also taking place this year. The Senate playing field narrowly favors Republicans, while the House remains a toss-up. Slim margins in Congress reinforce the difficulty of positioning portfolios in anticipation of election results.

ASSET CLASS PERFORMANCE

US Stocks Volatile in Late May, Tech Sector Faces Potential Correction

US stocks experienced renewed volatility in late May, with dip buying pushing the S&P 500 up nearly 1% on Friday 31st, marking its best month since February. Despite an initial drop driven by mega cap stocks, a rotation between technology and other industries lifted the market. Bank of America strategists warned that investors betting on tech giants might face challenges as other sectors catch up. Treasury yields fell as benign inflation data kept rate-cut hopes alive, contributing to a strong month for Treasuries. Analysts anticipate a bumpy ride for equities in June, with technology shares appearing overextended and possibly due for correction.

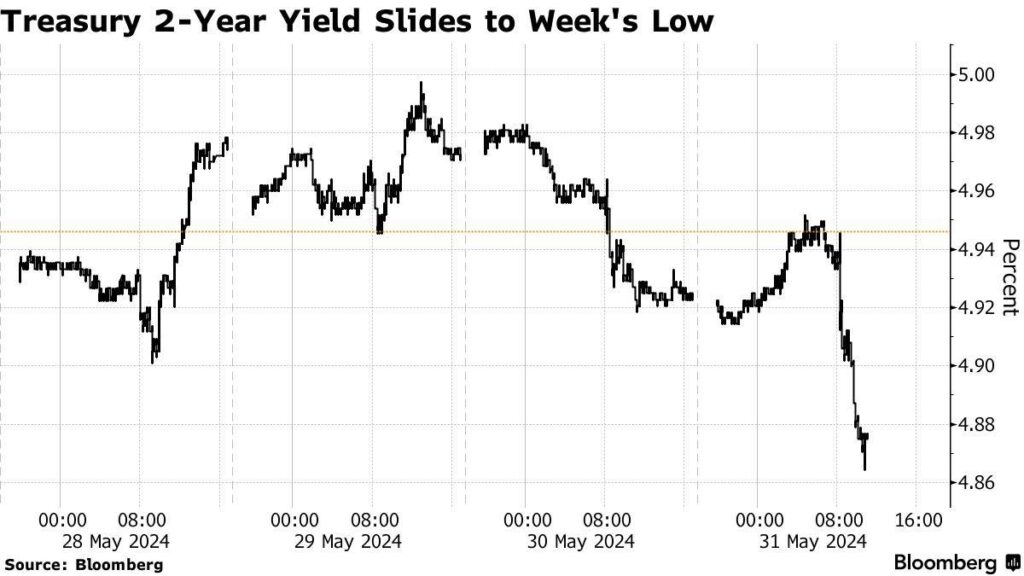

Bonds Rally as Inflation Data Supports Fed Rate-Cut Outlook

US government bonds rallied in the Last Week of May, bolstering their monthly gains, as stable inflation data sustained expectations for at least one Federal Reserve interest rate cut this year. The Fed’s preferred inflation gauge remained at 2.7% year-on-year, prompting Treasury yields to fall across maturities. Month-end rebalancing also supported the bond market, with passive investment funds purchasing Treasuries to mimic index performance. Despite some economic data still pending, the outlook for a potential Fed rate cut in September remains intact, reinforcing the attractiveness of Treasuries amid a “higher-for-longer” rate regime.

Commodities

Chile, the world’s leading copper producer, recorded its lowest monthly copper production in over a year, complicating its recovery from the first annual decline in two decades. In April, output fell 6.7% from March and 1.5% year-over-year, according to the latest statistics. The decline highlights ongoing challenges, including low ore quality and operational issues. Notably, Codelco’s Radomiro Tomic mine is still gradually restarting after a fatal accident in March. As oil prices remain volatile, commodity-exposed sectors serve a useful role in portfolios, particularly as hedges against geopolitical and inflation risk. Although there is limited upside for oil prices from current levels, the energy sector’s long-term prospects remain attractive due to a large valuation discount and structural tailwinds, including rising transportation needs in emerging markets. Ultimately, WTI and Brent crude closed the week lower at $76.99 and $81.11/bbl., respectively, after the US Energy Information Administration reported an estimated inventory increase of 1.8 million barrels for the week prior. Meanwhile, the price of gold slid to $2345.80/troy oz.

Currency

The US dollar is on track for its first monthly loss since December as easing inflation pressures bolster expectations of Federal Reserve interest rate cuts before year-end. The Bloomberg Dollar Spot Index dropped over 1% in May, weakening against major currencies. Even the yen, which declined for four consecutive months, strengthened in May following a record $62 billion intervention by Japanese authorities. The dollar’s reversal came after Fed Chair Jerome Powell downplayed concerns about rate hikes, and a smaller-than-expected increase in the consumer price index eased inflation worries. Bank of America’s foreign-exchange strategists noted that weaker US data reassured markets, with Fed speakers emphasizing a rate cut as the next move. The dollar’s strength had previously been driven by interest rate differentials, but expectations for Fed rate cuts have increased, with traders now anticipating one quarter-point reduction this year.