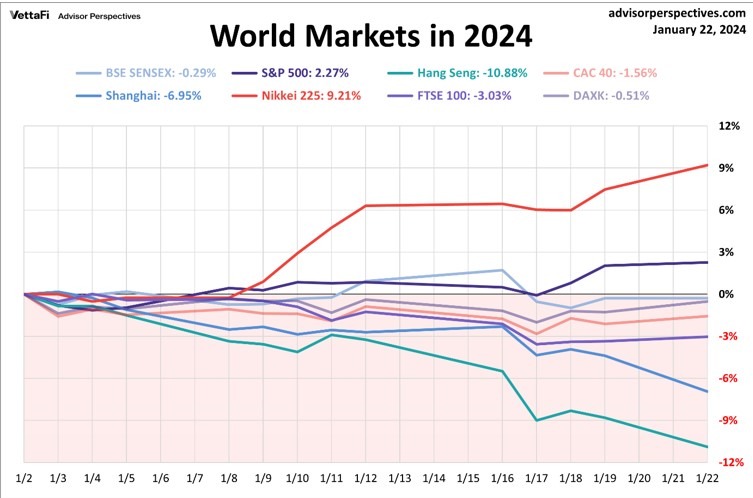

Two of the eight indexes on our world watch list have posted gains through January 22, 2024. Tokyo’s Nikkei 225 finished in the top spot with a YTD gain of 9.21%. The U.S.’s S&P 500 finished in second with a YTD gain of 2.27% while India’s BSE SENSEX finished in third with a YTD loss of 0.29%.

United States

Expecting the core Personal Consumption Expenditures index—the Fed’s preferred inflation measure, which excludes food and energy prices—to fall to 2.3% on a year-over-year basis by the end of 2024. It was 3.2% in November. The last mile of the journey back to 2% inflation will be challenging, however, owing to the “sticky” nature of services inflation.

Vanguard believes that market expectations for a Federal Reserve interest rate cut in March are overly optimistic. It likely will be midyear before policymakers are confident that they have reined in inflation sufficiently to start cutting their target for short-term interest rates.

In its latest Summary of Economic Projections (SEP), the Fed suggested it would trim its target for short-term interest rates with three 25-basis-point cuts in 2024. (A basis point is one-hundredth of a percentage point.) Vanguard believes the Fed will go further. We foresee the equivalent of six to eight quarter-point cuts—a total of 150 to 200 basis points—driven not by a soft landing but by the onset of a mild recession late in the year.

A higher unemployment rate than the Fed envisions would be commensurate with a contraction in GDP growth. We foresee a 2024 year-end unemployment rate of 4.8%, higher than the 4.1% envisioned in the SEP. For now, the labor market appears healthy.

China

Amid weak domestic consumption and private investment, stimulus will need to play a role in the revival of China’s economy. An indication of the government’s approach came on January 2, when the People’s Bank of China (PBOC) announced it had issued CNY 350 billion (USD 49 billion) in loans in December. The government chose to stimulate via its “pledged supplementary lending” facility, which provides support during property downturns. Vanguard expects the funds will be used toward supply-side projects, such as social housing construction and urban village renovation.

To mitigate deflationary pressure, the PBOC might ease its policy interest rate from 2.5% to 2.2% in 2024, as well as to cut banks’ reserve requirement ratios. The PBOC left its one-year medium term lending facility (MLF) policy rate unchanged at 2.5% on January 15.

Euro area

High-frequency data suggest that a further mild contraction occurred in the euro area economy in the fourth quarter. A preliminary estimate of fourth-quarter GDP, scheduled to be released January 30, could confirm that the economy fell into recession in the period after GDP contracted by 0.1% on a seasonally adjusted basis in the third quarter.

The economy is slowing broadly in line with our expectations at this stage of policy tightening by the European Central Bank, and we continue to expect that a recession will be mild.

Markets are pricing in ECB rate cuts totaling 140 basis points, beginning in the second quarter. We believe that rate cuts will total only 75 basis points and won’t begin until the middle of the year. (A basis point is one-hundredth of a percentage point.) Our outlook is predicated on the ECB’s own forecasting model. A risk to our view is that the ECB’s reaction to GDP and inflation data could deviate from the past as the central bank navigates a narrow path between inflation and recession risk.

United Kingdom

As in the euro area, economic growth in the U.K. continues to hover near zero. After modest growth in the first half of 2023, the U.K. economy contracted by 0.1% in the third quarter, a second GDP estimate showed. That was a revision from a preliminary estimate of 0% growth. High-frequency data suggest the economy stagnated or contracted minimally in the fourth quarter, in line with our outlook for a mild recession.

We continue to foresee fewer and later Bank of England (BOE) rate cuts than the markets do. We expect 100 basis points of policy rate cuts in 2024 beginning in the middle of the year at the earliest, compared with market expectations for 120 basis points of cuts beginning in May or June. (A basis point is one-hundredth of a percentage point.)

Emerging markets

Some central banks in Latin America, including those in Chile and Brazil, have already begun to cut policy interest rates, and we expect further cuts in 2024. But the gaps between high rates of monetary policy and receding rates of inflation are wide, particularly in Latin America, meaning that monetary policies are restrictive. We expect them to remain so even amid rate cuts.

In emerging Europe, where the gap between policy and inflation rates isn’t as large and policy is consequently less restrictive, we foresee first-half policy rate cuts amid economic growth concerns that are greater than in Latin America.

In emerging Asia, where inflation didn’t run as high and growth prospects appear brighter, we don’t foresee rate cuts until the second half of 2024.

Vanguard expects emerging markets GDP to grow mostly in line with consensus in 2024 and to a greater degree than that of developed markets.