February saw a further divergence in the performance of fixed income and equities investors as economic resiliency continued to drive down expectations for rate reduction.

Key Points

-

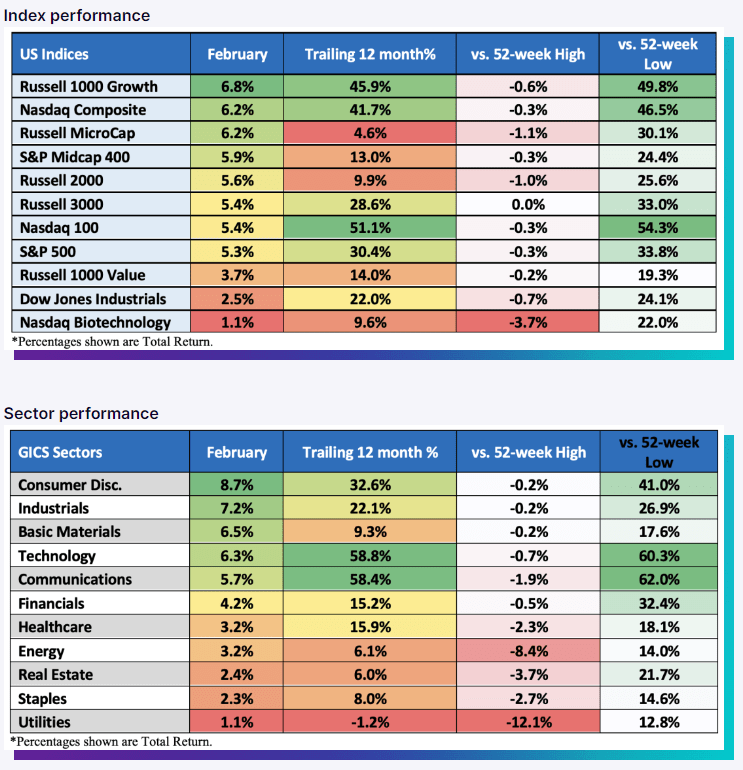

All major indices made new 52-week highs in February

-

S&P 500 closed above 5000 for the 1st time

-

S&P 500 reported earnings growth of 4%, the 2nd straight quarter of Y/Y growth

-

January inflation data is a bit stickier than expected

-

Fed rate cut expectations adjusted to June liftoff

Equity

Five of the “magnificent seven” US stocks released their results for the previous quarter as earnings season began. In general, these businesses matched or above projections, which helped the S&P 500 gain 5.3% during the month. Almost three quarters of the S&P 500 companies that have reported have exceeded analyst earnings projections. The US composite Purchasing Managers’ Index (PMI) indicated that activity continued to rise during February, while the US economy added 353,000 jobs in January. Economic statistics also demonstrated resilience.

The stock markets in Europe underperformed. In February, MSCI Europe ex-UK increased by 2.8%, while the developed market MSCI World Index saw an increase of 4.3%.

Despite a weaker-than-expected fourth-quarter GDP result (-0.1% quarter over quarter), which also sent the nation into a technical recession for the second half of 2023, the Japanese TOPIX Index increased 4.9% throughout the course of the month.

Prior to the month, the Chinese equities markets had fallen to five-year lows. But over the Lunar New Year vacation, activity figures improved, and the Chinese government made several encouraging announcements, such as lowering the prime rate on 5-year loans.

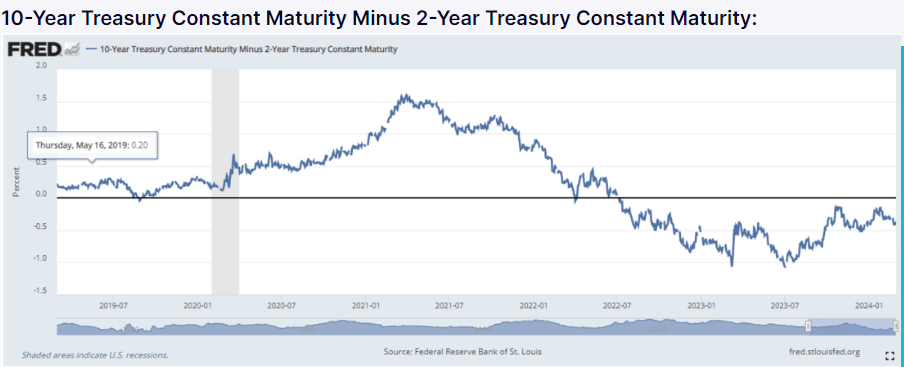

Fixed income

With headline inflation in the US for January at 3.1% year over year, the data was better than expected. This significantly dampened investors’ expectations for interest rate reductions from the Federal Reserve by 2024. As a result, pressure mounted on US Treasuries, which dropped 1.3% throughout the month.

Because of the increased wage pressure that suggests inflation may be stickier than expected, investors were once again forced to reduce their rate reduction projections for the Bank of England. Gilts in the UK fell and are currently down 3.6% so far this year.

Investment grade (IG) bonds underperformed credit-wise relative to less rate-sensitive high yield indexes. As of right now, the Bloomberg Global Aggregate Corporate index, which gauges the performance of IG bonds in developed markets, is down 1.9% for the year. In comparison, investors in euro high yield debt have profited 1.2% over the first two months of 2024, while US high yield has increased by 0.3%.

Federal Reserve

Investors had been expecting the decision to keep rates steady. Since Chairman Powell’s remarks during the most recent policy meeting in mid-December, which were framed against projections for slower economic growth and inflation likely fueled rate-cut expectations, the story has taken a different turn. For the time being, though, expectations seem to have been moderated by better-than-expected economic figures in December.