U.S.

Dow hits record high in broad advance

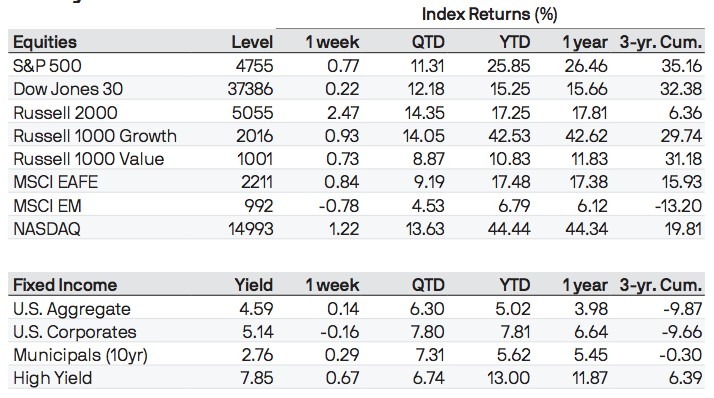

The S&P 500 Index, Nasdaq Composite, and Dow Jones Industrial Average recorded their seventh consecutive week of gains—the longest streak for the S&P 500 since 2017, according to Reuters. The gains lifted the first two benchmarks to 52-week highs and the Dow to an all-time record. Continuing a recent pattern, the week’s gains were also broadly based. In addition, the Cboe Volatility Index (VIX), Wall Street’s so-called “fear gauge,” fell to its lowest level in the post-COVID era.

Producer prices rise at slowest pace in nearly three years

The primary factor driving sentiment appeared to be a more benign inflation environment in the eyes of both investors and policymakers. Tuesday’s report on consumer price inflation was roughly in line with estimates, with core (excluding food and energy) inflation staying steady at a year-over-year rate of 4.0%. Producer price inflation report surprised modestly on the downside, with core inflation running at 2.0% for the year, a tick below expectations and its lowest level since January 2021.

Fed signals more substantial rate cuts ahead in 2024

Stocks had their biggest advance of the week in the wake of the report on Wednesday, which also corresponded with the Federal Reserve’s final policy meeting of the year. Officials left rates unchanged, as expected, but the quarterly “dot plot” summarizing individual policymakers’ rate expectations indicated that the median projection was for 75 basis points of rate cuts coming in 2024, up from the 50 basis points of easing in their previous projection. Investors also seemed encouraged that Fed Chair Jerome Powell did not appear to push back on futures markets’ pricing of aggressive cuts next year in his post-meeting press conference.

Retail sales data on Thursday arguably disrupted the disinflation narrative, but investors appeared to take it in stride. Retail sales unexpectedly rose 0.3% in November, while October’s decline was revised lower, indicating a strong start to the holiday shopping season. Online sales and sales at restaurants and bars were particularly strong, indicating resilience in discretionary spending. Other data released during the week indicated some surprising weakness in the manufacturing sector, however.

Long-term bond yields continue sharp decrease

Long-term U.S. Treasury yields fell sharply on the inflation data and Fed signals, bringing the yield on the benchmark 10-year U.S. Treasury note below 4% for the first time since the end of July. (Bond prices and yields move in opposite directions.)

According to our traders, investment-grade corporate bonds underperformed Treasuries before the Fed meeting on Wednesday. After the Fed’s dovish pivot, corporates outperformed in the risk-on environment. High yield corporate bonds also performed well in the wake of the meeting.

Europe

In local currency terms, the pan-European STOXX Europe 600 Index ending the month 3.57% higher as financial markets appeared to increasingly expect key central banks to cut interest rates in 2024. Major stock indexes were mixed. France’s CAC 40 Index gained 3.07%, but Germany’s DAX and Italy’s FTSE MIB were modestly higher. The UK’s FTSE 100 Index added 3.60%.

European Central Bank keeps borrowing costs at record high

The European Central Bank left its key deposit rate unchanged at a record high of 4.0% but cut its inflation and growth forecasts for 2023 and 2024. The bank called for inflation to slow to just below its 2% target by 2026, a move widely seen as paving the way for a reduction of interest rates. It expects the economy to grow 0.6% this year, a tick below the previous projections, and 0.8% in 2024, down from 1.0%. It also said it would phase out the reinvestment of maturing securities in its emergency pandemic program over the back half of 2024.

Business activity in the eurozone shrank in December, according to S&P Global. An early estimate of the Purchasing Managers’ Index (PMI) based on the combined output of the manufacturing and services sectors fell to 47.0 from 47.6 in November, a two-month low and a seventh consecutive month below 50, the level that indicates contraction.

Bank of England steady on rates, keeps tightening bias

The Bank of England kept its benchmark interest rate at 5.25% for a third month running in November, as expected. However, policymakers reiterated their willingness to increase borrowing costs again if evidence of more persistent inflation were to emerge.

Official data showed that the UK economy shrank in October by 0.3% sequentially, after rising 0.2% in September. Relative to the three months to July, UK gross domestic product was flat in the three months to October.

Norges Bank raises rates; Swiss National Bank keeps rates unchanged

Norway’s central bank raised its key rate by 25 basis points to 4.5%, its 13th hike this cycle. It said rates would remain unchanged until the fall of next year, but given uncertainty about future economic developments, it did not rule out either another increase or a reduction earlier than currently envisaged.

Meanwhile, the Swiss National Bank kept its policy rate unchanged at 1.75% for a second month running, as was widely expected. It also reduced its forecasts for inflation—to 1.9% in 2024 and to 1.6% in 2025.

Japan

Japan’s stock markets fell over the month, with the Nikkei 225 Index losing -0.37 % and the broader TOPIX Index down -0.79%. Shares were supported by the U.S. Federal Reserve giving the clearest sign yet that it will pivot away from monetary policy tightening, as it held interest rates steady and projected more aggressive rate cuts in 2024. Yen strength posed a headwind for Japan’s exporters, however.

The yield on the 10-year Japanese government bond fell to 0.62%, from 0.72% as of today since start of the month, as speculation about the Bank of Japan (BoJ) ending its negative interest rate policy sooner than anticipated waned amid the focus on the Fed’s policy pivot. In this context, the yen strengthened to the JPY 141 level against the U.S. dollar, from the high range of JPY 144 the prior week. Much of this strength was due to expectations about narrowing U.S.-Japan interest rate differentials.

Data releases paint a mixed picture

December PMI data showed that Japan’s private sector experienced a mild expansion in business activity over the month, as a stronger rise in services activity offset a quicker contraction in manufacturing. Separately, the BoJ’s quarterly “tankan” survey suggested growing optimism among Japan’s large manufacturers. This could bode well for companies’ ability to hike wages, adding to the positive price-wage spiral that the BoJ is waiting to see become entrenched as a condition for normalizing monetary policy further. The central bank will next meet on December 18–19.

Political funds scandal embroils ruling party

Prime Minister Fumio Kishida has seen his popularity plummet and credibility dented amid news of a political funds scandal that has embroiled the ruling Liberal Democratic Party (LDP). Factions of the party have been accused of underreporting income from fundraising events, and four LDP cabinet ministers tendered their resignations during the week. Tokyo prosecutors have launched a corruption probe.

China

Chinese equities declined as persistent deflationary pressures weighed on the economic outlook. The Shanghai Composite Index fell 0.94% while the blue chip CSI 300 gave up -2.3% MTD. In Hong Kong, the benchmark Hang Seng Index rose 2.69% amid a global stock rally after the Fed kept interest rates steady on Wednesday and signaled it may start cutting them next year. China’s consumer price index fell 0.5% in November from the prior-year period, accelerating from October’s 0.2% contraction and marking the steepest drop since November 2020 as lower pork prices weighed on food prices. Meanwhile, the producer price index dropped a bigger-than-expected 3% from a year ago, marking the 14th monthly decline. Deflation is concerning for China since economists worry it could unleash a downward spiral of economic activity.

Other November data continued to paint a mixed picture of China’s economy. Industrial production grew a better-than-expected 6.6% last month from a year earlier, while retail sales surged 10.1% but missed expectations. Fixed asset investment rose a weaker-than-forecast 2.9% in the first 11 months of the year as declines in infrastructure growth and real estate investment deepened. The urban unemployment rate remained steady from October at 5%. In monetary policy news, the People’s Bank of China (PBOC) injected RMB 1,450 billion into the banking system via its medium-term lending facility compared with RMB 650 billion in maturing loans. The medium-term lending facility rate was left unchanged as expected. Liquidity injections are seen as a part of the central bank’s continuing efforts to counter economic headwinds. Analysts predict that the PBOC will step up policy support in 2024 as the government ramps up measures to boost China’s economy.