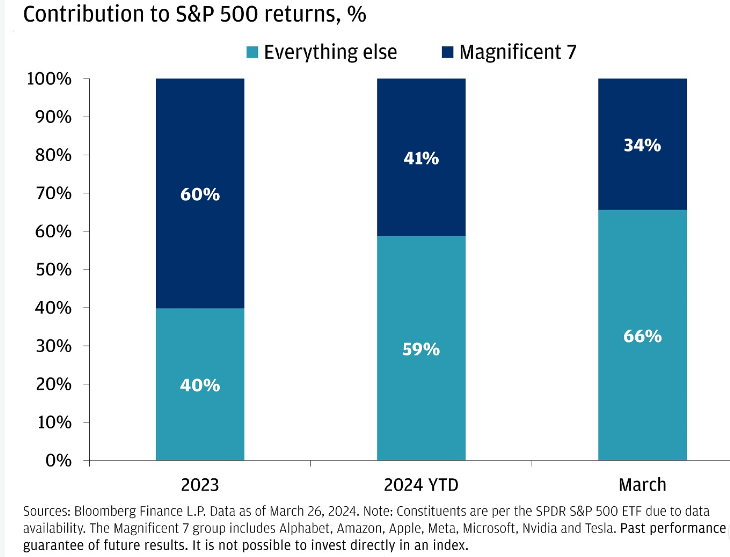

The S&P 500 looks set to finish March in the green. That means stocks have now been on a winning streak for five consecutive months. What is even more impressive is how the rally has evolved on the coattails of last year.

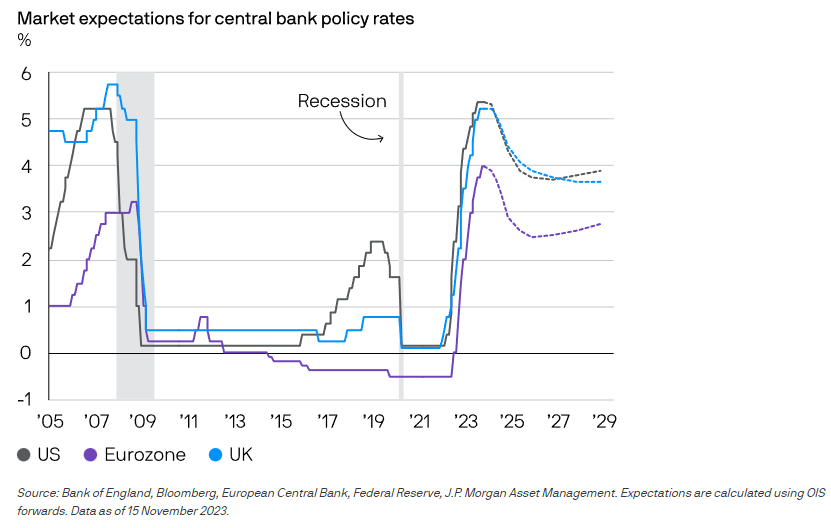

2023 came to a spectacular close as anticipation for significant rate cuts by the Federal Reserve caused equities and bonds to rise in lockstep. The consensus back in January was that the Fed should continue with the “soft landing,” which involved cutting rates by more than 160 basis points. These days, those hopes have been slashed almost in half. We now anticipate just 75 basis points of easing, or three cuts, this year, along with the Fed.

Thus far this year, the S&P 500 has risen far past the 5,000 thresholds, setting over 20 new all-time highs. Given that Apple and Tesla underperformed this year and that the Magnificent 7 has lost two of its bigger anchors, this is particularly noteworthy. Nevertheless, two of the greatest performers from the previous year have persisted in bolstering additional gains. This year, Nvidia has outperformed all other S&P 500 members (except from Super Micro Computer, which just joined the index). The chipmaker has gained an additional 80% this year after rising by more than 200% the previous year.

Since yields on government bonds continue to trade substantially above anticipated inflation, they offer investors an appealing bargain. Right now, markets are not giving the likelihood of unfavorable economic scenarios any weight. Therefore, we anticipate more dramatic interest rate cuts from central banks than what is presently priced into future curves if developed market economies slow down or enter a recession.

There is especially attractive value in U.S. Treasuries at the five-year region of the yield curve, making them a recommended overweight exposure. If additional significant rate cuts are implemented over the course of the next several years, the curve may re-steepen. Most of the main developed sovereign markets, including Canada, Germany, Australia, and the UK, continue to have favorable outlooks for government bonds. Japan is the only country whose yields are significantly out of line with global averages and exhibit a downward trend.

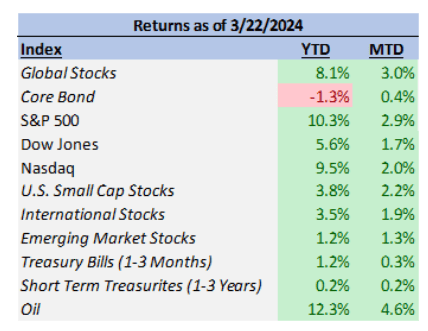

With a return of 10.3%, the S&P 500 has been the best segment of the equities market thus far this year. On a sector level, the largest gainers from the index thus far this year have been information technology (14.02%) and communication services (16.42%), although sector involvement has been wide, with double digit gains also being achieved by financials (10.88%) and industrials (10.39%).

March saw a significant recovery in energy as well, with returns of over 8% for the month, bringing the total gain for the year to 11.16%. With a drag of -2.89%, the real estate sector has been the lone loser so far this year. This is the largest performance anomaly.

International stocks (3.5%) and emerging markets (1.2%) have lagged the U.S. big cap stock market thus far this year. For these businesses, the dollar’s rise has caused challenges. Headwinds are so great, that even though hedged overseas developed corporations have stayed up with their US counterparts, currency drags have nearly neutralized those gains.

Since the 10-year Treasury yield has increased year to year, bonds have lost 1.3% of their value this year. U.S. bonds have gained about 7% since October 27; yields are still much below their October highs.

In summary, we continue to have a positive perspective on the state of the market, which is supported by the most recent Fed decision and the overall trend of the most recent economic data. Of course, there are dangers associated with this favourable setup, and even in the absence of a major negative development in the background, we do expect some periods of volatility to manifest.

The market’s upward momentum and the Fed’s intentions to lower interest rates will both be greatly impacted by the inflation statistics during the coming months. Although we do not expect it, there might be a repricing of interest rate expectations and volatility if the inflation data keeps going beyond forecasts or becomes worse.