Risk-on tone was hindered, with equities slipping while bonds and dollar gained in the pre-Thanksgiving trading. FOMC minutes garnered little reaction, while commentary from BOE officials was more hawkish. GBP turned out to be the G10 outperformer while EURUSD reversed back to 1.09. Copper surged to fresh two-month highs and Gold looked over $2k.

US Equities:

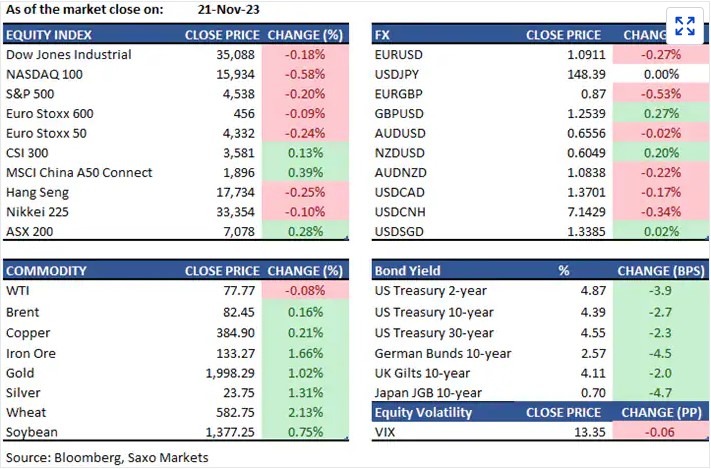

Markets pulled back modestly, with the S&P500 declining 0.2% to 4,538 and the Nasdaq shedding 0.6% to 15,934. Information tech was the worst-performing section in the S&P500. Microsoft dropped by 1.2% as OpenAI was in discussion with Sam Altman, including possibly his reinstatement as CEO. Retailers underperformed. Lowes slid 3.1% after cutting forecasts and Kohl’s and Best Buy declined after missing estimates and downbeat outlooks. After the market close, Nvidia reported results surpassed analysts’ forecasts for revenue and profits but warned that advanced chips that are subject to US licensing requirements to ship to China “will decline significantly.” Nvidia’s shares dropped by over 1% in the extended trading.

Fixed income:

Treasury yields edged lower in a choppy session, with the 2-year yield falling 4bps to 4.87% and the 10-year yield sliding 3bps to 4.39%. The FOMC minutes offered no significant information. The results from the $15 billion 10-year TIPS were weak and the inflation-protected securities were awarded at 3.2bps higher in yield than the level traded at the auction deadline, a low 2.18x bid-to-cover ratio and softer non-dealer demand.

FX:

The dollar firmed on Tuesday, reversing higher from 103.20 as some consolidation ensued after the dollar’s sharp decline earlier in the week. GBPUSD pushed higher to 1.2560 highs amid hawkish BOE commentary and focus shifts to Autumn statement. The EUR/USD however slipped back to 1.09 – with the big figure support holding up – suggesting gains to 1.10 could return. USDJPY returned above 148, but support at 100DMA at 146.61 remains in focus. AUDUSD softened to sub-0.6560 despite hawkish RBA minutes yesterday and 200DMA at 0.6588 remains in focus. USDCNH bounced off the 200DMA and PBOC’s fixing will be key again today to drive a move towards 7.10.

Commodities:

Crude oil prices steadied after gains since Friday brought Brent to over $82/barrel amid OPEC supply cut expectations. API inventory data showed a build of 9.05 million barrels last week, but data was largely ignored, and focus turns to EIA figures due today ahead of Sunday OPEC meeting. Copper touched 2-month highs buoyed by continued Yuan strength, China stimulus hopes, strong demand from the renewable industry and supply concerns. Gold broke above USD 2,000/oz.

Macro:

FOMC minutes were balanced and garnered little market reaction, as they noted that all participants agree to ‘proceed carefully’ and would be watching whether sufficient progress has been made in bringing down inflation. Officials generally agreed to keep rates on hold for some time and noted that financial conditions had tightened significantly.

Bank of England speakers including Governor Bailey pushed back on market pricing for rate cuts. He said inflation risks were still on the upside, with wage pressures and Mideast conflict risks underpinning. BOE’s Mann also said a further interest rate increase was warranted.

ECB’s Lagarde said that it may be too early to declare victory on inflation. She emphasized that the ECB will ‘remain attentive’ to “ensure that our policy rates will be set at sufficiently restrictive levels for as long as necessary” but “can act again if we see rising risks of missing our inflation target.” Separate comments from Board member Schnabel echoed inflation fears as well.

Macro events:

UK Autumn Statement, Dutch Elections, US Durable Goods (Oct), US Uni. of Michigan Final (Nov), Australia Flash PMIs (Nov)

Major Events:

The economic calendar was highlighted by a whopping 4.9% real GDP growth in the third quarter and a September Personal Income and Spending report that failed to show a strong trend of disinflation. Those reports reflect ongoing strength in the economy and inflation looks somewhat sticky, which is not likely to persuade the Fed to cut rates anytime soon.

The Bank of Japan’s tweak to its yield curve control policy was not as hawkish as feared, tempering concerns about the possibility of a destabilizing unwinding of carry trades.

Another important factor driving activity in the Treasury market was the FOMC meeting. The committee voted unanimously to leave the target range for the fed funds rate unchanged at 5.25-5.50% and Fed Chair Powell’s press conference was deemed less hawkish than feared. Mr. Powell noted that the Fed has come very far with its rate-hike cycle and that policy decisions have gotten more two-sided.

The Bank of England also left its key rate unchanged, although the vote was 6-3 with three voters favoring a 25-basis points rate hike.

The sharp drop-in rates acted as a springboard for stocks, aided by short-covering activity and a fear of missing out on further gains in a seasonally strong period for the market. Last week brought the S&P 500 into technical correction territory, but this week’s rally brought the S&P 500 back above both its 200-day and 50-day moving averages.

The US dollar was weaker this week due to the thought that the Fed might be raising rates. The US Dollar Index fell 1.4% to 105.04.