Overview

April 2025 continued the challenging market environment that began in March, as investors grappled with the aftermath of newly announced tariff policies and persistent economic uncertainty. Following President Trump’s April 2nd tariff announcement, markets spent much of the month digesting the implications of these protectionist measures, which exceeded most analysts’ expectations in both scope and scale. The initial market reaction was largely negative, with continued volatility as investors assessed potential retaliatory measures from trading partners and the prospect of prolonged nation-by-nation negotiations.

U.S. Equity Markets

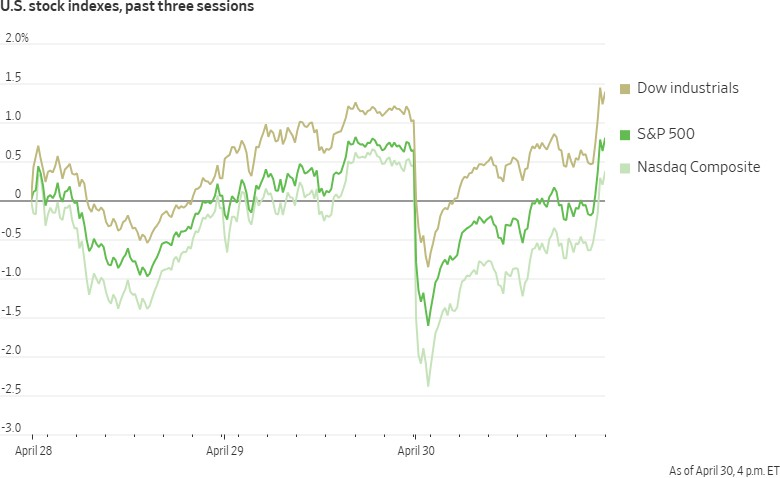

U.S. equity markets remained under pressure in April, extending the downturn that began in March. The S&P 500 retreated an additional 3.2% for the month, bringing year-to-date losses to approximately 7.5%. The technology-heavy Nasdaq Composite performed even worse, declining 4.1% as investors continued to reduce exposure to high-valuation growth stocks.

The sector divergence observed in March became more pronounced in April. Energy maintained its position as the top-performing sector year-to-date, benefiting from supply concerns and geopolitical tensions. Defensive sectors like Consumer Staples, Healthcare, and Utilities continued to outperform the broader market as investors sought safety amid economic uncertainty.

The “Magnificent Seven” tech giants, which had been the primary market drivers in 2023 and early 2024, continued to experience significant selling pressure in April. This rotation away from mega-cap technology stocks allowed for a narrowing of the performance gap between market-cap weighted and equal-weighted indices, though both remained negative for the year.

Small-cap and mid-cap stocks, which underperformed in March, showed some relative stabilization in April but remained significantly negative year-to-date. These segments continued to face pressure from concerns about their vulnerability to economic slowdown and higher borrowing costs.

International Markets

International markets presented a mixed picture in April, with several regions outperforming U.S. equities:

Europe: European markets demonstrated resilience in April, with the MSCI Europe index posting modest gains of 1.2%. German equities continued their strong performance, adding to their impressive 15.6% year-to-date gain through March. The UK market also remained positive, though gains moderated compared to earlier months.

China: Chinese equities continued their recovery in April, building on March’s momentum with an additional 2.5% gain. This performance was supported by government stimulus measures and improving sentiment toward Chinese assets after significant underperformance in recent years. Year-to-date, Chinese equities now stand as one of the best-performing major markets globally.

Japan: Japanese markets stabilized in April after a flat Q1, gaining 1.1% for the month as investors reassessed the Bank of Japan’s monetary policy stance and the impact of a persistently weak yen on exporters.

India: After a difficult start to the year, Indian equities experienced a modest recovery in April, gaining 1.8%. However, this only partially offset the 3.0% year-to-date decline recorded through March, as investors remained cautious about elevated valuations and potential impacts of global trade tensions.

Emerging Markets: Broadly, emerging markets outperformed developed markets in April, with the MSCI Emerging Markets index gaining 1.3%, building on the positive momentum from March. This outperformance came despite concerns about the impact of U.S. tariffs on export-dependent economies.

Fixed Income Markets

Bond markets showed mixed performance in April as investors balanced expectations for Federal Reserve rate cuts against persistent inflation concerns and also over the market noise for the change of fed chair Powell and trump’s stance towards it. The U.S. Aggregate Bond Index edged up 0.4% for the month, bringing its year-to-date return to approximately 3.2%.

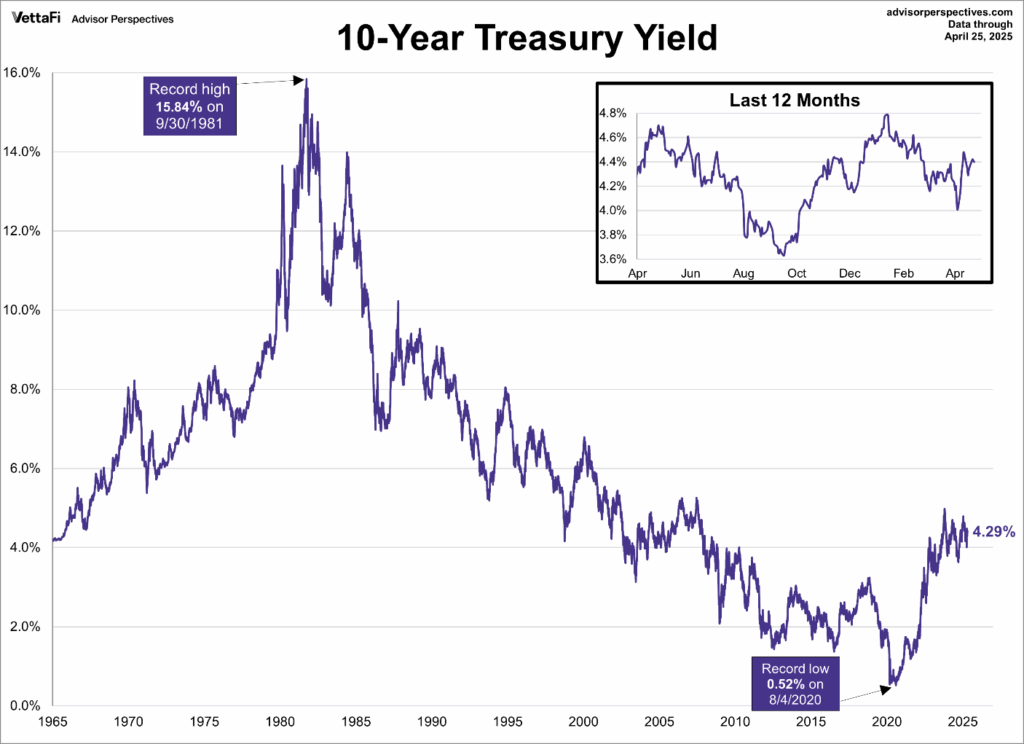

Treasury yields stabilized somewhat in April after the volatility seen in March. The 10-year Treasury yield ended the month at 4.1%, down slightly from the 4.2% recorded at the end of March, reflecting a cautious stance from investors amid uncertainty about economic growth and inflation.

Investment-grade corporate bonds underperformed Treasuries in April as credit spreads widened modestly on concerns about the potential impact of tariffs on corporate profitability. High-yield bonds faced more significant pressure, declining 0.7% for the month as investors reduced exposure to lower-quality credits amid economic uncertainty.

Municipal bonds stabilized in April after a difficult March but remained negative year-to-date. The segment continued to face challenges from concerns about local government finances in a potentially slowing economy.

Market expectations for Federal Reserve policy shifted somewhat in April, with futures markets pricing in fewer rate cuts for 2025 than previously anticipated. This adjustment reflected concerns that tariff-induced price increases could keep inflation elevated, potentially limiting the Fed’s ability to ease monetary policy.

Commodities and Cryptocurrencies

Commodities: April saw divergent performance across commodity markets. Energy prices weakened, with WTI crude oil declining 3.5% to approximately $67.50 per barrel on concerns about demand in a potentially slowing global economy. Gold continued its strong performance,

adding another 2.8% to reach $3,213 per ounce as investors sought safe-haven assets amid market uncertainty and geopolitical tensions. Industrial metals faced pressure from concerns about Chinese demand and the potential impact of trade tensions on global manufacturing.

Cryptocurrencies: The cryptocurrency market experienced increased volatility in April, with Bitcoin declining approximately 8% to $76,000 from its March close of $82,548. This correction followed significant gains earlier in the year and reflected broader risk-off sentiment in financial markets. Despite the April decline, Bitcoin remained significantly higher year-to- date, supported by continued institutional adoption and the impact of the early 2024 halving event.

Economic Outlook

The economic outlook became increasingly uncertain in April as preliminary data confirmed negative GDP growth in Q1, raising concerns about a potential recession. Consumer and business sentiment indicators continued to deteriorate, with the University of Michigan Consumer Sentiment Index falling to its lowest level since late 2022.

Inflation data remained stubbornly high, with concerns growing that the implementation of new tariffs could exacerbate price pressures in certain sectors. Major retailers warned of potential price increases for consumers, adding to the challenging economic environment.

Labor market data showed signs of cooling in April, with job growth slowing and unemployment ticking up slightly. Corporate earnings reports were mixed, with many companies lowering forward guidance citing tariff concerns and economic uncertainty.

Looking ahead, market participants remain focused on several key questions: How will trading partners respond to new U.S. tariffs? Will the Federal Reserve prioritize fighting inflation or supporting economic growth if conditions deteriorate further? Can corporate earnings remain resilient in the face of economic headwinds?

The prevailing market view suggests continued volatility through mid-year as these questions are resolved, with the potential for stabilization later in 2025 if tariff uncertainties clear and economic growth stabilizes. In this environment, security selection and sector allocation decisions remain paramount, with opportunities emerging in segments that have experienced significant valuation compression despite maintaining solid fundamentals.