1. Global growth & policy environment

- Global economic conditions remain complex going into Q4 2025: growth has shown unexpected resilience even as inflation, trade frictions and policy uncertainty persist.

- In the US, mixed signals: consumer/business sentiment softens, labour market shows signs of strain, yet investment and tech remain robust.

- Monetary policy: The Federal Reserve (Fed) is keeping a tightrope while markets expect cuts, the Fed emphasises inflation risks, diminishing the “rate cut is assured” narrative.

- Allocation-tilts: For October, asset manager views show equities upgraded to overweight, fixed income/bonds downgraded, and alternatives (incl. gold/precious metals) held as hedges.

Key themes

- Tech / AI remains a dominant driver of equity gains, especially in US/EM.

- Bond yields remain elevated; fixed income carry is low, making bonds less attractive relative to equities.

- Commodities (especially energy/oil) see supply-side pressures; gold remains elevated amid macro/geopolitical risk.

2. Equities

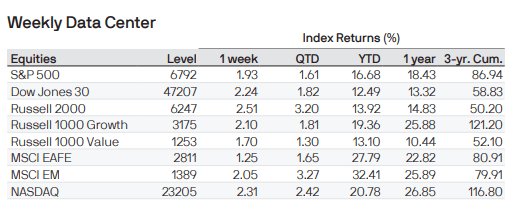

Performance snapshot October 2025

- In the US: S&P 500 up ~2.3% in October, Nasdaq Composite up ~4.7%, Dow Jones Industrial Average up ~2.5%.

- Markets ended the month on a strong note, aided by solid earnings (notably from major tech/AI firms) and optimism on trade/tension reduction.

Drivers & risks

- Upside: Resilient earnings, AI / tech adoption, improving U.S.–China trade dialogue.

- Risks: Elevated valuations (particularly U.S. tech), rate-cut uncertainty, concentration risk (top stocks form large share of indices).

Outlook

- Given the allocation commentary: equities remain the preferred risk asset for now; still, returns may rely more on earnings growth than valuation rerating.

- Regions: EM and Japan (via corporate reform/AI) cited as interesting areas.

3. Fixed Income

Market context

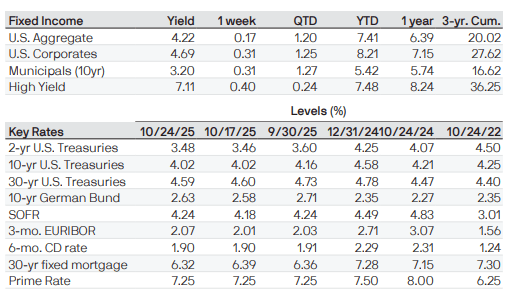

- Yields remain relatively high and credit spreads tight meaning returns for bonds are muted.

- Allocation view: Bonds downgraded to underweight in October, given persistent inflation risks and limited upside in yields.

Key metrics & insights

- The 10-year U.S. Treasury yield had declined during the month but remained at elevated levels relative to previous years, limiting the duration premium.

- Corporate bond spreads (e.g., U.S. investment grade) are near historical lows — reducing the margin of safety.

Outlook

- Fixed income is likely to serve a diversifier / hedge role rather than major return generator.

- Selectivity is important: Emerging markets local-currency debt, short-dated bonds may have better risk-reward.

4. Gold & Commodities

Gold

- Gold reached fresh highs amid safe-haven demand and inflation/monetary policy uncertainty.

- Despite the strong recent run, gold remains a hedge within portfolios given its low correlation with equities/bonds.

Crude Oil & Energy

- For crude oil (e.g., West Texas Intermediate or WTI), October saw bullish impulses: supply discipline from OPEC+, geopolitical risks, but tempered by demand concerns.

- The allocation commentary sees commodities as beneficial in inflation/real-asset hedges, though valuation in commodity super-cycles is a longer-term view.

| Asset Class | Approx. October Return* | Oct Allocation View |

| Equities (Global) | +2-5% (US S&P ~2.3%)) | Overweight |

| Fixed Income (Global) | Flat to slightly negative | Underweight |

| Gold / Precious Metals | Strong positive (new highs) | Neutral-Overweight hedge |

| Crude Oil / Energy | Positive, but volatile | Strategic/commodity tilt |

5. Asset Allocation Implications & Strategy

Portfolio take-aways for Q4

- Risk assets (equities) remain favoured, but with caution: rely more on earnings growth than valuation expansion.

- Fixed income: lower conviction for strong returns focus on short duration, higher-quality, or select EM local debt.

- Gold/Alternatives: position as tail-risk hedge and real-asset inflation buffer.

- Commodities/Energy: Given supply constraints/geopolitics, these are a useful tactical tilt but subject to demand softness risk.

Key scenarios to monitor

- If the Fed cuts sooner than expected → risk assets get a boost.

- If inflation proves sticky and rates remain higher for longer → fixed income suffers, bonds repricing.

- If geopolitical or trade stresses increase → safe havens (gold) and energy may outperform.

- If growth falters (especially in China/EM) → equity returns could weaken, and commodities may stall.

6. Outlook & Risks

Positive catalysts ahead

- Strong earnings in tech/AI continuing into Q4 (especially after surprise results in October).

- Easing trade tensions and stabilising supply chains.

- A shift from rate-hike fear to rate-cut expectation, supporting valuation multiples.

Key risks

- Valuation stretch in equities (especially concentrated tech) increases downside risk.

- Sticky inflation or hawkish central bank commentary could derail bond markets and risk assets.

- Demand slump in major economies (US/China) could hurt commodities and earnings.

- Geopolitical shocks or supply chain disruptions—while could benefit energy/gold, harm global growth.

Conclusion

October 2025 was characterised by resilient equity markets (especially in tech/AI), constrained fixed income return prospects, strong performance and hedge value for gold/commodities, and a macro backdrop of policy uncertainty but moderate optimism. Looking ahead to Q4, the balance of risks remains firmly in favour of equities, but with increased importance of earnings delivery, selective fixed income positioning, and hedging through alternatives.