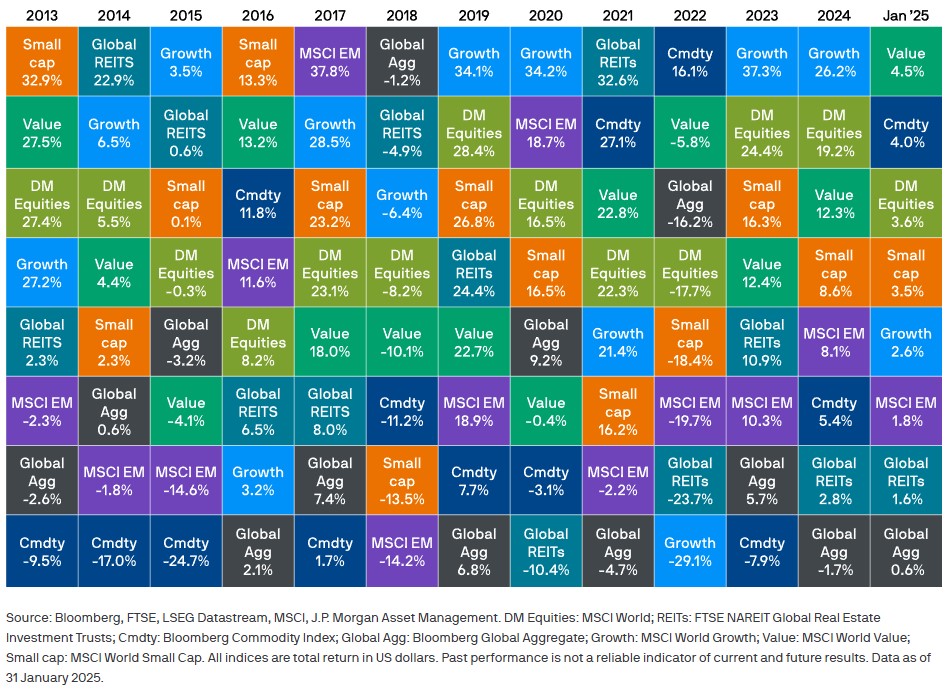

Investors had a great start to 2025, with both bonds and stocks generally yielding gains.

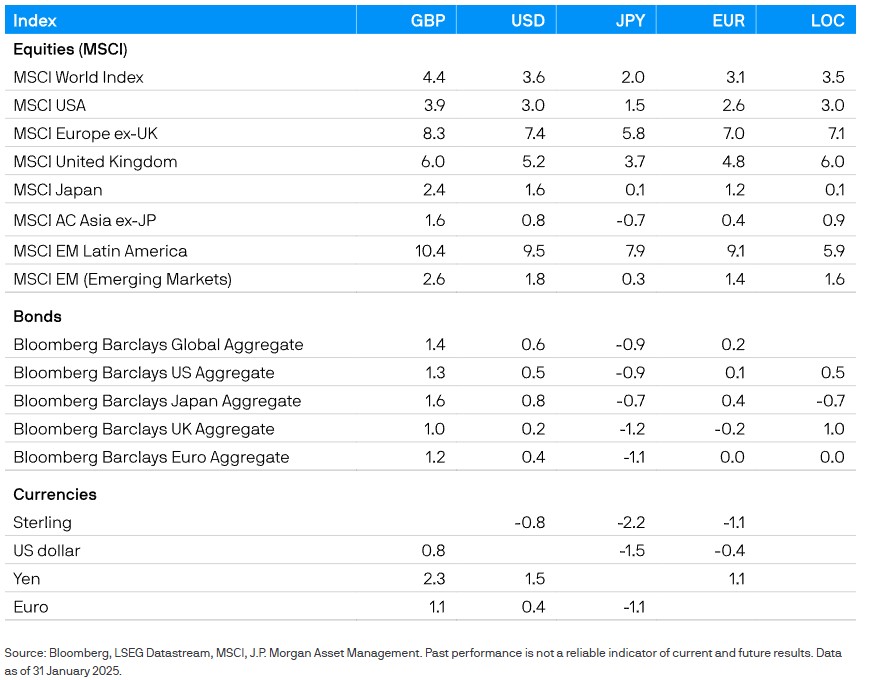

Value stocks (+4.5%) outperformed their growth counterparts (+2.6%), while Europe (+7.1% for the month) outperformed the US (+2.8%) in the equities market, which marked a change from the two-year norm. US stocks benefited from President Trump’s return to the White House and his “America First” policy agenda, but the rise of the Chinese artificial intelligence (AI) firm DeepSeek raised doubts about the US technology sector’s capacity to meet high standards.

The month of January was marked by increased volatility in the bond markets. Global rates increased as a result of President Trump’s planned policy combination of tax cuts, immigration restrictions, and tariffs, which fueled predictions of rising US inflation. However, despite narrower credit spreads and a lower-than-expected US December inflation report, the Bloomberg Global Aggregate Bond Index closed the month up 0.6%.

With a 4.0% increase in the broad Bloomberg Commodity Index, commodities were among the month’s best performers. While severe winter weather and US sanctions on Russia helped to boost oil prices, Trump’s tariff threats caused gold and other commodity prices to rise.

A look back at markets in January when European shares outperformed other regions and US leadership in artificial intelligence was challenged by China’s DeepSeek.In January, US shares increased, although they behind other areas as Chinese start-ups DeepSeek posed a threat to US artificial intelligence (AI) leadership. While the information technology industry declined, other industries prospered, with the financial, healthcare, and communication services sectors leading the way.

As investors processed reports that DeepSeek had trained its generative AI capabilities to generate outcomes equivalent to the market leaders but at a fraction of the cost, shares of AI-related businesses, including NVIDIA, saw some steep declines. This could have raised doubts about the necessity of making further investments in cutting-edge AI technology and data center space. Meanwhile, several of the US megacaps had mixed results as the Q4 earnings season began.

In addition to holding interest rates steady, the Fed hinted that there might not be any more rate decreases in the near future. Data on non-farm payrolls showed that the US labor market was doing well; in December, 256k new jobs were created to the economy, which was more than anticipated. Core inflation, which does not include the cost of food and energy, decreased from 3.3% in November to 3.2%, according to data from the Bureau of Labor Statistics.

Credit spreads in the investment grade corporate sector in the US were very stable, approaching the narrowest levels in several decades, despite a high supply. On the other hand, corporate bonds from the UK and Europe did well, with spreads getting tighter. (Credit spreads, which represent the extra risk investors assume when lending to firms as opposed to the government, are the yield differential between corporate bonds and risk-free government bonds.)

High yield markets were also doing well, especially in the US, where attractive yields, good corporate earnings, and indications of a thriving economy all contributed to strong investor demand.

With Bitcoin fluctuating between $90k and $110k before closing the month up 10%, January was a successful month for digital asset markets. Net flows from exchange-traded funds (ETFs) were strong. Significant dispersion was observed in other crypto assets than Bitcoin. Since net ETF flows started to slow down, Ethereum closed the month essentially unchanged. Following the introduction of Trump Coin natively on the chain, Solana recorded a new all-time high before reversing some of the gains and closing the month up 19%.

January emphasized the need of geographical diversity by highlighting the danger that investors face due to the high level of concentration in the US stock market and strong expectations for results. Tighter credit spreads contributed to higher bond returns outside of stocks. Even if the world economy appears to be doing well right now, as we noted in our 2025 Investment Outlook, government bond allocations will be crucial if high political tensions erode corporate confidence and slow global growth. However, alternatives will be a greater diversifier during turbulent times if inflation and fiscal generosity continue to be the major concerns.