Balancing Optimism with Rising Uncertainty

November 2024 brought a mix of optimism and caution as markets reacted to the Republican victory in the U.S. elections. While equity indices such as the S&P 500 and Nasdaq reached new all-time highs, the potential for significant policy shifts introduced uncertainty that could reshape the global economic outlook. Volatility eased as clarity emerged, with the VIX curve unwinding its inversion. U.S. equity futures showed inflows into U.S. and Japanese markets, while Europe and China faced outflows.

Key Impacts of U.S. Election

The Republican sweep raises the likelihood of inflationary fiscal policies, prolonged high interest rates, and weaker economic growth. Proposed tariffs, tax changes, and shifts in immigration policy add to the uncertainty. Tariffs of up to 60% on Chinese imports could escalate trade tensions, driving inflation and potentially halting the Federal Reserve’s easing cycle by 2025. While lower corporate taxes may support near-term growth, rising deficits could strain fiscal sustainability in the medium term.

Economic Scenarios: Baseline vs. Alternative

In the baseline scenario, global inflation is expected to moderate, interest rates to decline, and economic growth to remain steady, albeit unspectacular. However, an alternative scenario modeled by S&P Global Market Intelligence predicts significant economic impacts if proposed policies are enacted. U.S. real GDP could decline by 0.3 percentage points by 2026, while global GDP growth may fall by 0.4 percentage points.

China would face the largest impact among U.S. trading partners, with a GDP reduction of 1 percentage point, while Asia-Pacific could experience a 0.7 percentage point decline. Europe, facing existing economic challenges, risks recession, particularly in trade-sensitive economies like Germany.

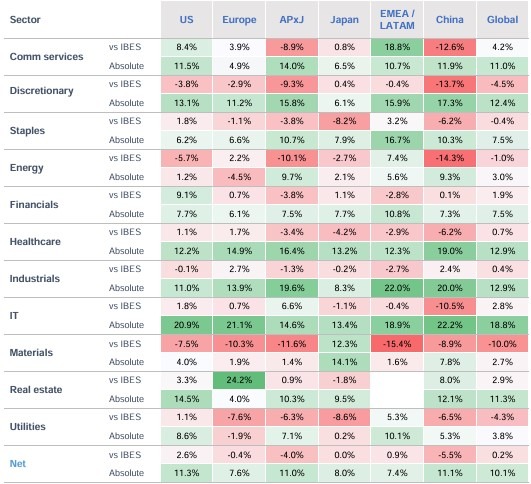

Regional and Sector Insights

In the U.S., Treasury yields rose by over 80 basis points since mid-September, reflecting expectations of fiscal expansion and reduced Fed rate cuts. The U.S. dollar strengthened by 3.1% in Previous month, creating headwinds for commodity-exporting economies. Growth-oriented sectors such as aerospace, defence, and luxury goods are poised to benefit from increased fiscal spending.

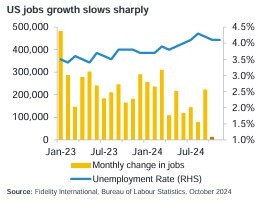

Europe’s equity markets saw their largest monthly decline in over a year, driven by weak domestic growth and strained trade relations with China. In China, equity markets fell nearly 6% as a lack of significant stimulus and ongoing trade tensions weighed on investor sentiment. Meanwhile, Asia-Pacific markets presented a mixed picture. Taiwan outperformed with robust AI-driven Q3 earnings, while India experienced a 7.7% correction due to weak corporate results. Korea, despite a 25bps rate cut, struggled with disappointing earnings, making it the weakest performer in the region.

Commodity and Inflation Trends

The outlook for crude oil prices has softened, with the 2025 Brent crude forecast revised down from $75/b to $71/b. Unless OPEC+ reduces production plans, the global oil supply is expected to exceed demand, which could help temper inflation. However, tariffs and fiscal expansion may counteract these deflationary effects.

Inflation trends across G5 economies remained favorable, with core goods inflation staying negative for the sixth consecutive month in September at -0.2%. Services inflation, while gradually easing, remained elevated at 4.2%, reflecting persistent pressures in labor markets.

Market Outlook: Opportunities and Risks

Despite the risks, U.S. markets appear well-positioned for a year-end rally. The reopening of the corporate buyback window and resilient consumer demand offer tailwinds. Growth-oriented fiscal policies could provide additional support in sectors with strong fundamentals.

However, investors should remain cautious. Rising geopolitical tensions, persistent inflation, and elevated interest rates could constrain growth and increased volatility. Europe’s economic fragility and the potential escalation of U.S.-China trade disputes add to the risk landscape.

Conclusion

November 2024 underscored the need for a balanced investment approach. While political clarity and fiscal expansion present opportunities, the risks of elevated inflation, trade disruptions, and fiscal constraints demand vigilance. Selectivity will be crucial, with a focus on sectors and regions with long-term growth potential and robust fundamentals.