A Comprehensive Overview of the Global Economic Landscape

Macro-Economic Overview

Inflation

In June, the global landscape reflected a mixed picture across major economies, with key indicators influencing market sentiment and policy expectations. Inflation remained a central theme, particularly in the US, where core PCE inflation moderated to 2.6% year-over-year in June, easing from 2.8% in May. This decline, albeit slight, suggested some alleviation in price pressures, reinforcing expectations that the Federal Reserve might initiate rate cuts starting in September. Similarly, in the Euro area, headline CPI exceeded expectations, highlighting persistent inflationary pressures despite efforts by the European Central Bank to stimulate economic growth.

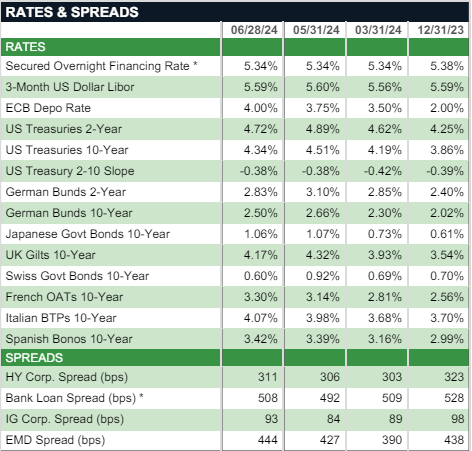

Rates

Monetary policy divergence was evident, with the Federal Reserve maintaining its benchmark rates but hinting at potential future easing, contrasting with the Bank of England’s decision to hold rates steady at 5.25%. The UK’s CPI slowing to 2.0% year-over-year, reaching the Bank of England’s inflation target, provided temporary relief, however elevated core inflation at 3.5% underscored ongoing economic challenges.

Politics

Political developments added another layer of uncertainty. In the US, the first presidential debate sparked market volatility, influencing investor sentiment regarding the outcome’s potential impact on economic policies and market stability. In Europe, the French parliamentary elections saw significant gains for far-right parties, contributing to market unease and widening risk premia across the Eurozone.

Asset Class Performance

Equities

Equity markets showed varied performances throughout June. US equities, represented by the S&P 500, reached new highs but ended the month slightly lower by 0.06%, reflecting cautious investor sentiment amid mixed economic data and political uncertainties. European equities, including the STOXX 600 and FTSE 100, faced downward pressure, declining by 0.69% and 0.82%, respectively, following political uncertainties post-elections.

Fixed Income

Fixed income markets exhibited cautious optimism. US Treasury yields showed mixed movements, with the 10-year yield ending the month at 4.34%, influenced by Federal Reserve signals and economic growth indicators. In the Eurozone, bond yields rose, with German bunds and French OATs reflecting increased risk perceptions post-elections, ending at 2.50% and 3.30%, respectively.

Commodities

Commodity markets responded to geopolitical tensions and supply dynamics. Oil prices, represented by WTI and Brent crude, rose by 5.5% and 5.5%, respectively, amid Middle East tensions and supply concerns, closing the month higher despite initial volatility. Crude Oil finished the month higher at $80.73 and $85.24/bbl, respectively, as US crude oil inventories declined more than consensus had anticipated. Gold prices showed moderate gains, rising by 2.3%, driven by economic uncertainties and lower treasury yields, maintaining cautious market sentiment.

Currencies

The US dollar index gained 0.07% against a basket of currencies, reflecting mixed economic data and central bank policies. The euro and pound sterling remained resilient against the dollar, supported by economic fundamentals and central bank actions. Conversely, the Japanese yen weakened significantly, reaching 38-year lows against the dollar, prompting discussions on potential interventions by the Bank of Japan to stabilize the currency.