Overview

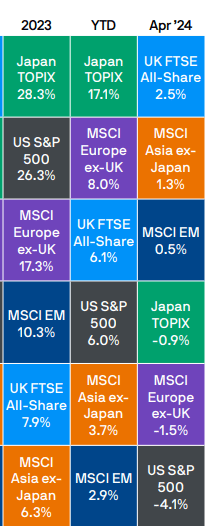

April proved to be a challenging month for the fixed income and stock markets. Market concerns that central banks will not loosen monetary policy as soon as originally anticipated were stoked by a combination of hot US inflation data and a first-quarter US GDP print that, despite appearing poor at first glance, demonstrated robust private demand. The global bond market saw a 2.5% monthly decline, while developed market stocks saw a 3.7% decline. The stock and bond markets also saw a negative response. On the other hand, more exposure to commodities and heightened investor interest in inexpensive Chinese stocks enabled developing market equities to produce gains of 0.5% throughout the month.

Fixed Income

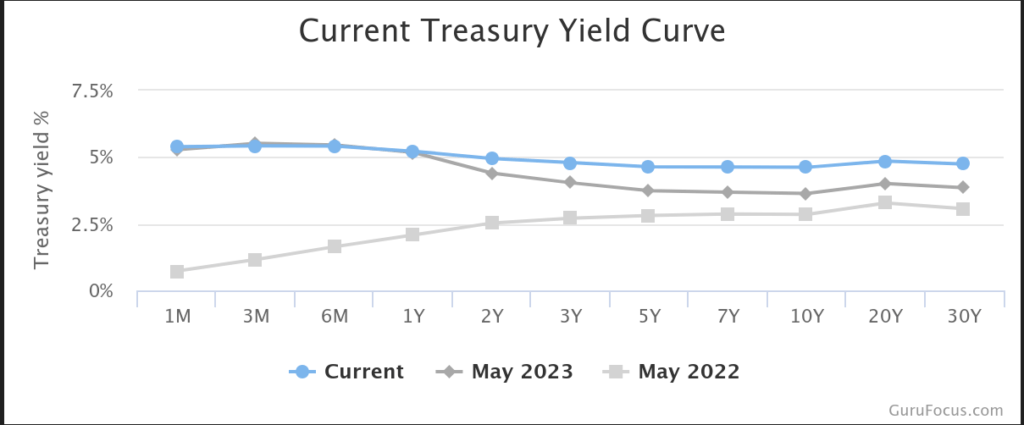

The shift in rate expectations also had a negative impact on fixed income markets. The US market priced in 1.5 rate cuts this year in April alone, delaying the first cut’s implementation date. There was a 40-basis point (bps) increase in 2-year Treasury yields to 5.0% and a 47bps increase in 10-year Treasury yields to 4.7%.

The region’s performance was caused by a less noticeable increase in euro bond yields. This pattern was visible in the credit markets, where spreads didn’t move in April because of the positive growth forecast; the only significant industry to avoid negative returns was euro high yield. Euro sovereigns performed better in bonds than US Treasuries and UK Gilts. Additionally, the eurozone’s relatively high-growth periphery outperformed central Europe.

Equities

The S&P 500 experienced a 4.1% monthly decline as rising bond yields put pressure on values. Although the bar was set low, firms generally exceeded expectations during the first quarter earnings season, with the economic environment continuing to be favorable for corporate earnings. However, because investors were trying to determine if earnings justified the last six months of valuation expansion, markets were more inclined than usual to penalize companies who missed projections. European equities outperformed their US counterparts. The eurozone’s flash composite PMI (purchasing managers’ index) rose to 51.4 in April, significantly above the December recessionary level of 47.6, while the UK’s composite PMI rose to an expansive 54. Improved growth prospects and inflation dynamics in the region were able to partially compensate for the headwinds of higher for longer interest rates and geopolitical risks.

Commodities

Commodity prices increased due to a strong economic climate and the threat of escalation in the Middle East. As the best-performing major asset class at the end of April, the Bloomberg Commodities Index rose 2.7%. Rising energy costs along with less sensitive interest rates helped the value sector of the equities market do better than the growth segment in comparison.